Opendoor, The Mythology Of Disruption

Finding Product Market Fit, Competition, and the Importance of Being Misunderstood

Welcome to the 225 new and curious minds who have joined The Operator since August 1! If you are reading this but have not subscribed, join 360 clever and good-looking people by subscribing here:

“Prometheus – trickster, rebel and hero – links the realm of the gods with the world of humanity, with which he had such close affinity. His act of stealing fire has been viewed as the foundation of all man’s technologies.”

-Neil MacGregor

The first technological advancement was fitting in its boldness, and its story demonstrates how myth grazes history.

Fire was the harbinger of civilization, and uncountable are our ancestors who told tales of its discovery. The most famous of these parables involves the Titan, Prometheus. Call it fate or good storytelling that the first technology was delivered by a being whose name means ‘forethought.’

As the legend goes, Prometheus, the Herald of the Titans, sided with the Olympians in the Titanomachy; the war against the old gods. Prometheus’ wit and farsightedness played a pivotal role in the ascension of Zeus and the Olympians. However, Zeus’ early tyrannical rule displeased Prometheus, who felt humans deserved a far kinder master. And so, Prometheus stole the fire of Olympus, which he delivered to mankind on a lit fennel stalk. To this day, the Olympic flame ceremony celebrates Prometheus, the Thief of Fire.

In fire was the ultimate disruptor, well beyond 10x better than the darkness it chased. Elegant and utile flames catalyzed the advent of civilization; economy and art, music and ice cream, instapots and baseball.

And yet as far as we’ve voyaged on the wings of disruption, one industry remains obstinate in its resilience to change – residential real estate. When compared against innovation in computing, medicine, or war, buying and selling a home has looked remarkably similar over the years. Housing disruption fell by the wayside, too big, too slow, too complex a problem to optimize for. Sure, Zillow and Redfin improved discovery, but they did nothing to refine the transaction, where the pain points are most dense.

And then along came Opendoor.

Founded in 2014, Opendoor is the creator and category leader of iBuying, which is the digital buying and selling of residential real estate. Led by visionary co-founder and CEO Eric Wu, Opendoor aims to replace the traditional, painful, home buying/selling process with a digital experience that is fast, certain and simple.

Over the past 7 years Wu and Co have executed beautifully, building the operational culture required to upend the largest market in history. Although it’s early days, we may be witnessing a generational company in the making — a future mega-cap. And yet, as of the time of this writing, $OPEN is down more than 60% from all-time highs, priced at less than one times forward revenues. Macro concerns, an unvetted business model and profitability skepticism cloud otherwise blue skies of investment opportunity.

For the investor graced with Prometheus-esque foresight, the opportunity has never been nearer – cloudless skies and a big blue ocean of it. But the thesis requires a freshened perspective. For this, my tenth article, I believe I am up to the task.

In today’s briefing, I aim to unpack and declutter the misunderstood iBuyer, Opendoor, with particular treatment of the following:

- The importance of being misunderstood

- The (Odious) Bear Case

- The characteristics of disruption at scale

- Flywheel mythology

- What happens if Opendoor wins?

- Playing the Game of Prometheus

The Importance Of Being Misunderstood

“If you’re not comfortable with being misunderstood for long periods of time, you probably shouldn’t do anything new or interesting.”

Eric Wu, Opendoor CEO and Co-Founder

I have written two previous articles about Opendoor (here and here), where I explain in granularity the business model and economics. But a quick primer:

In one breath, iBuying is the business of buying and/or selling a home online, including ancillary services such as mortgage or title and escrow.

On the Opendoor app or website, homeowners can sell to Opendoor for a transparent fee of 5% of sale price, and 1% in closing costs. Given realtors traditionally charge 6% in commission fees plus closing costs, Opendoor’s 5% rate drives thousands of dollars in value right out of the gate. Check.

But Opendoor’s true value proposition lies in the fourth dimension: time.

Prior to the Hot Housing Summer of 2021, homeowners closed sales in an average of 87 days. Selling to Opendoor takes less than a week, and involves almost no talking to strangers. Sellers simply upload a video of their home, fill out details, and receive a digital offer within minutes.

That means no staging or cleaning, no open houses with sun-dried tomato aioli sandwiches, no witless negotiating or watching offers fall through. It also means customers have immediate equity to purchase their next home.

But how is this possible? How can a software company price something as nebulous (and heterogenous) as residential real estate, site-unseen? The answer is Automated Valuation Models (AVM).

Opendoor’s pricing algorithm, or AVM, is the secret sauce; the performant soul of iBuying.

Built by Ian Wong (Stanford dropout, data scientist, Opendoor CTO and co-founder), Opendoor’s AVM is the best in the business – a first of its kind machine-learning platform that actively ingests historical pricing information alongside hundreds of datapoints per home, customized within each market to arrive at a fair price. Once the offer is in, Opendoor sends an inspector to the home for a final walkthrough, and the offer is confirmed.

Voila! You have just teleported through one of the most stressful financial experiences of your life, emerging from the digital portal with thousands in savings and all of your hair. It’s no wonder Opendoor sports the highest net promoter score (NPS) I’ve seen in the real estate or software space (>80).

The (Odious) Opendoor Bear Case

And although Opendoor’s offerings are strongly resonating with consumers, it remains woefully misunderstood. I spend an undue amount of time devotedly battling bears from the parapets of Twitter and Seeking Alpha, reiterating the core principles of the investment thesis. There are two commonly flung bear arguments today, the first of which is:

Zillow and Redfin can do everything Opendoor can, but also have high margin advertising businesses to fund growth. Opendoor will lose against these businesses.

OK, fine, this argument should be easy enough to verify by comparing unit economics. All else equal, the company who has the pricing and operational advantages makes the most per home sale.

Can we agree on that?

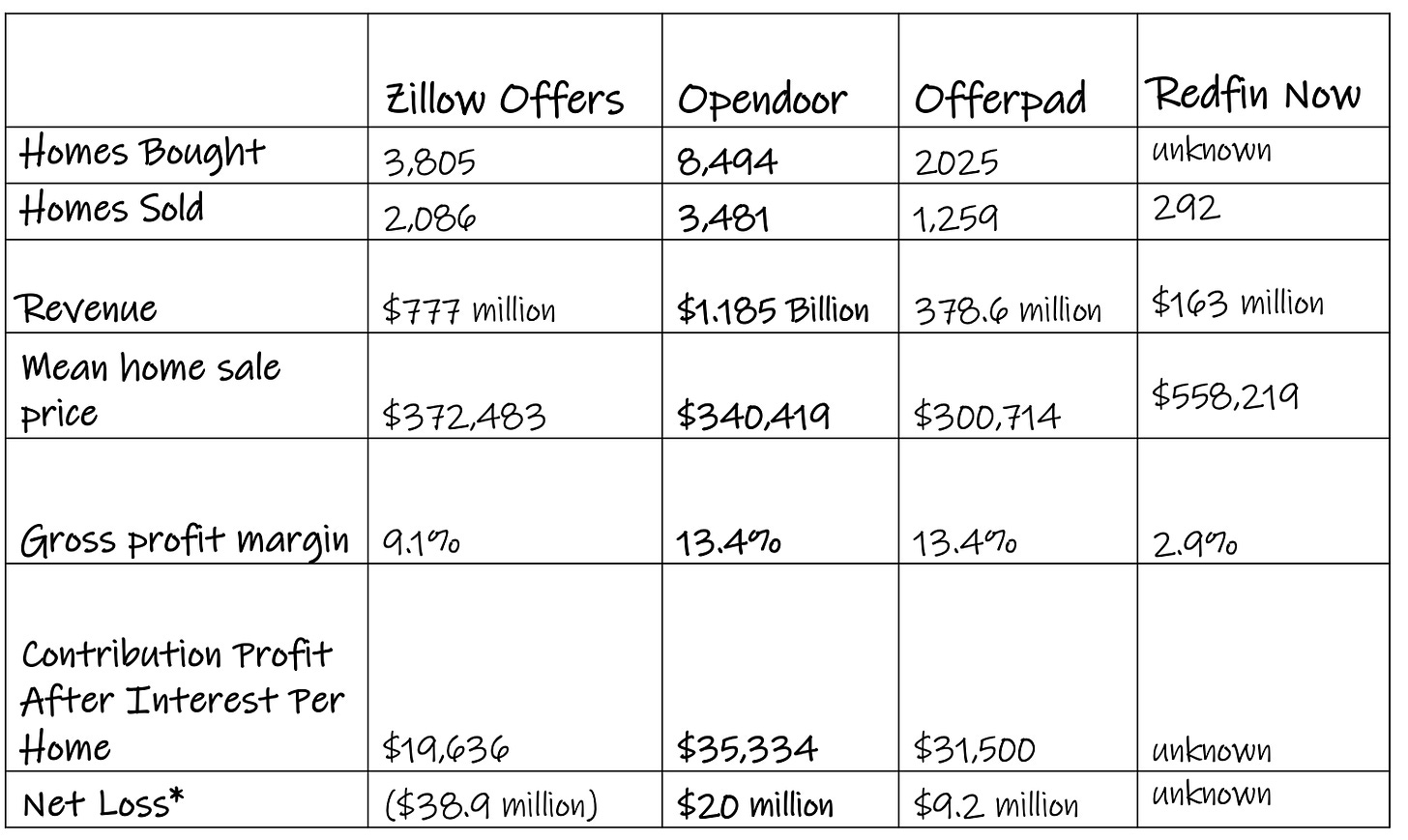

As of Q2 2021, Zillow commanded a respectable gross profit margin of 9.1%, Redfin posted an industry-low 2.9%, and Opendoor led by a mile, at 13.4%.

Opendoor is therefore better able to monetize the transaction. It does this by having superior pricing ability (AKA the software, or AVM is better), as well as operational execution. It’s probably premature to include Redfin in the iBuying conversation, as Opendoor’s iBuyer profit margin is 362% higher. Yikes.

That leaves us with Zillow. Many argue Zillow is Opendoor’s fiercest competitor, but the Rich Barton-led tech company is leaning into its iBuying venture more gently, allowing space for Opendoor to widen the lead. From Q1 to Q2 2021, Opendoor grew iBuying revenues by 58.6%, whereas Zillow grew but 10.8%. Furthermore, in Q2 Opendoor increased home acquisitions by 136%, whereas Zillow posted 105%.

That Opendoor can both grow more quickly and at higher profit margins should be sufficient to refuse the notion Opendoor has true competition today. And like any machine-learning-informed algorithm, Opendoor’s AVM will continue to benefit from larger-scale data consumption, resulting in compounding improvements in pricing over peers.

While I don’t want to deviate too far afield, Zillow and Redfin having high margin businesses built on advertising, search and realtor relationships might paradoxically be a limitation rather than a strength. I question whether companies with soft-serve ice cream stations and nap pods have the right type of culture to succeed in a low margin business like iBuying.

Zillow and Redfin have never been forced to incorporate that spartan, fiercely frugal, carved-from-wood poise hardcoded into Opendoor’s DNA.

Since day 1, Opendoor’s very existence has been predicated on prudent capital allocation and operational execution to obtain a single-digit margin. The entire business, and therefore the culture, lives and dies by the basis point. Zillow and Redfin are simply in a different category. Innovators, yes, but not operators.

That brings us to argument #2:

Opendoor is only succeeding because the housing market is hot. In a real estate downturn, house prices will fall, and Opendoor will fold. Rising interest rates will destroy already paper-thin margins.

To paraphrase what I’ve previously said, the eerie thing about digital is that we never go back. Once traditional commerce is replaced by a digital experience that is faster, easier, and cheaper, it becomes the new benchmark – the expectation.

This isn’t speculation, it’s human nature. Traditional home buying with a realtor, stacks of paper documents to sign and contracts with shady mortgage brokers — these will become a relic of a lost age, like bloodletting, or steam energy.

Today we have millions of homeowners selling into the best RE market in history. Admittedly, that’s good for Opendoor’s profitability. But perhaps a year from now when the market cools, homeowners will not be fielding offers $100k over asking price and firstborn naming rights. No, a return to normalcy will force us back to that much-loathed 80+ day home sale process. Meanwhile, 75+ million millennials will be entering the market for the first time, realizing how miserable the process is, how byzantine.

Inconsolable, these millennials will do what they were born to do: get on Google and figure out a better solution, one that delivers speed, certainty, and simplicity. This is when the next wave of growth crashes into Opendoor, allowing Wu and Co to ride the rising iBuying surf to sunny shores.

That brings us to macro concerns. What about rising interest rates, or a home selling slowdown? Surely rising interest rates and a drop in home prices would extinguish this growth story?

Actually…it doesn’t look like that’s true either. While low interest rates are somewhat of a boon for Opendoor’s business, the financial impact of rising interest rates is insignificant.

Let me prove it to you.

Opendoor is primed to purchase 40k homes this year, or 10k homes per quarter, and holds each home for roughly three months. Opendoor finances the majority of home acquisitions through debt, holding only 20% equity in homes on the balance sheet. At an average price of $300k with a 20% equity stake, a 1% rise in interest rates would result in only $6 million increase in quarterly interest costs.

Pretty reasonable for a company guiding for Q3 run-rate revenue of $10 Billion, right? Furthermore, Opendoor can alter holding periods depending on the interest rate and home price appreciation environment. In other words, if interest rates rise, Opendoor may prioritize selling velocity, resulting in lower holding costs.

Okay, so interest rates appear manageable. But what about a cooling housing market?

According to Zillow’s home value index, the mean home price in the U.S. is $298k, 20% higher than it was in January, 2020. Rising home prices benefit Opendoor’s margins, but eventually we will reach the top, and homes might depreciate in value. This could leave Opendoor holding thousands of homes it overpaid to acquire, with higher holding costs due to lower velocity inventory turnover.

Again, this risk is overstated.

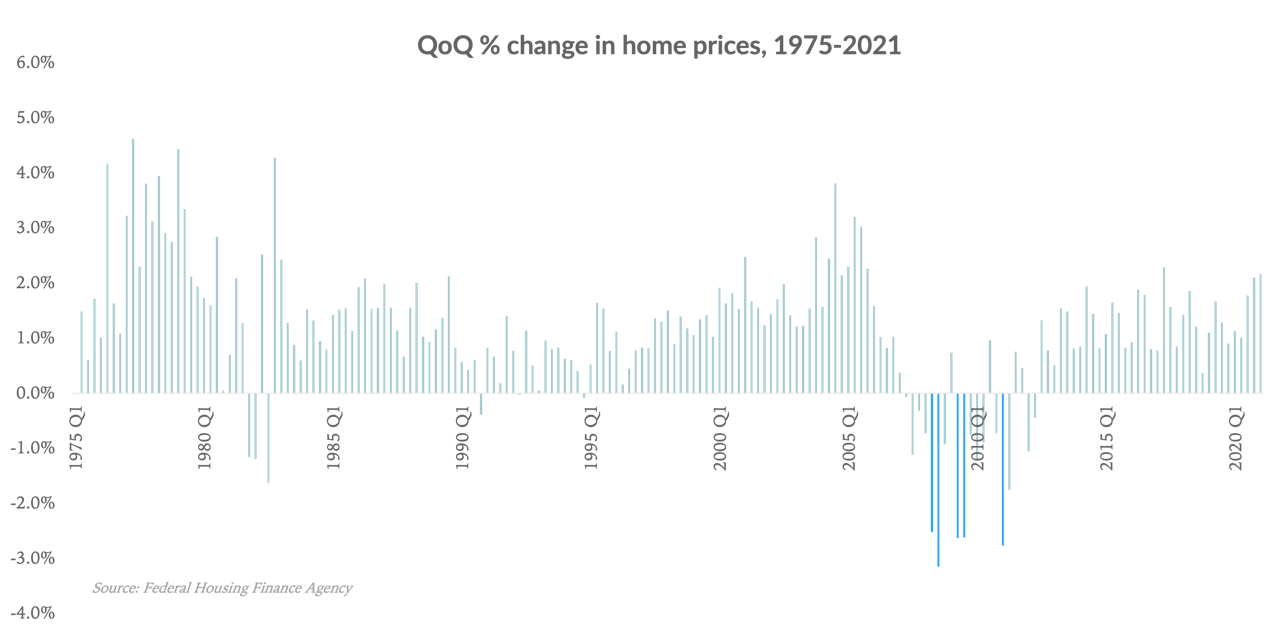

Home prices move at glacial speeds. According to Loup Ventures, over the past 187 quarters, home prices have declined in only 11.7%, or 22 quarters. And even when they decline, they do so at an unhurried, old-man-walking-in-the-park, pace.

“In fact, it took more than five years for home prices to move from peak to trough following the housing crisis of 2007, with only five quarters experiencing price declines of more than 2.5%, meaning swift downward volatility is uncommon.

Loup Ventures, iBuyers Can Manage Macro Risks, emphasis mine

Source: Loup Ventures

Notwithstanding an uncomfortable few years following the worst housing crisis in almost a century, concerns regarding falling real estate prices seem overblown. Furthermore, bank legislation and regulatory oversight in response to the 2008 housing crash was effected to prevent such events from repeating themselves.

Perhaps most importantly, all of your equity investments did poorly during the 2008 recession, so housing crisis risk is not exactly unique to Opendoor.

All things considered, Opendoor might actually grow during a cold real estate market. On the Q1 earnings call, CFO Carrie Wheeler was quick to point out Opendoor is housing cycle-agnostic.

“And certainly, in a down market, which is more uncertain for consumers, we believe that the certainty our product provides will be an even greater value to customers in that scenario…

I believe that we are going to continue to be market share gainers across all cycles as a result of that. Certainly, we are right now. And we expect that the value proposition, as I said, only increases in times of uncertainty for sellers.

Carrie Wheeler, Opendoor CFO, Opendoor Q1 2021 Earnings Call

Ms. Wheeler might not know it, but she is touching on a fundamental psychology, one that bleeds into economics and most financial decisions we make.

This is called risk aversion.

Risk aversion is the tendency of people to prefer outcomes with low uncertainty over outcomes with high uncertainty, even if the latter outcome results in equal or higher value. “A bird in the hand is worth two in the bush,” and all that.

Let’s apply risk aversion to Opendoor in a ‘down market.’

Achilles wants to sell his house, but the market is cold.

In such a scenario, Achilles is more likely to find equivalent (or higher) value selling his home for 95% true value immediately, compared to seeking 100% value in the open market, which could take months, and might not happen.

This is the same reason investors buy low-growth dividend stocks over high risk growthy stocks, why people buy bonds – people instinctively assign greater value to guaranteed money over potential money, even if the potential money is higher. This is risk aversion.

And while many welcome the risk of high growth and volatile names, I’d wager risk-seeking behavior rarely extends to the home buying and selling process. After all, we have Robinhood, drugs and Draftkings to sate risk appetites. In a down market, the certainty, speed and simplicity of Opendoor’s offerings are even more compelling.

The true macro trend is not what temperature the market is, but rather the massive secular shift in consumer demand for a digital-first solution to buy and sell a home.

Wall Street’s misunderstanding of Opendoor has resulted in a staggering plunge in share price, resulting in a compelling buying opportunity. This touches on a fundamental aspect of my investment thesis in early companies — the importance of being misunderstood.

I believe having a misunderstood business is that critical piece most correlated with outsized returns. More than TAM, margins, or who is at the helm, it is the market’s Eureka! moment of finally valuing a misunderstood business that drives vertical upside and multiple expansion.

Your misunderstood business is my opportunity.

iBuying Is Disruption At Scale

“It’s similar to flying a plane and you have to fix the plane while you’re flying.”

Eric Wu, Opendoor CEO and Co-Founder on growth

In their 2020 investor presentation, Opendoor laid out an audacious goal to achieve 4% marketshare in 100 U.S. markets within the decade, with an annual revenue target of $50 Billion. If accomplished, Opendoor would become a Fortune 100 company; one of the largest 100 companies in the United States.

And yet, they’d be just getting started.

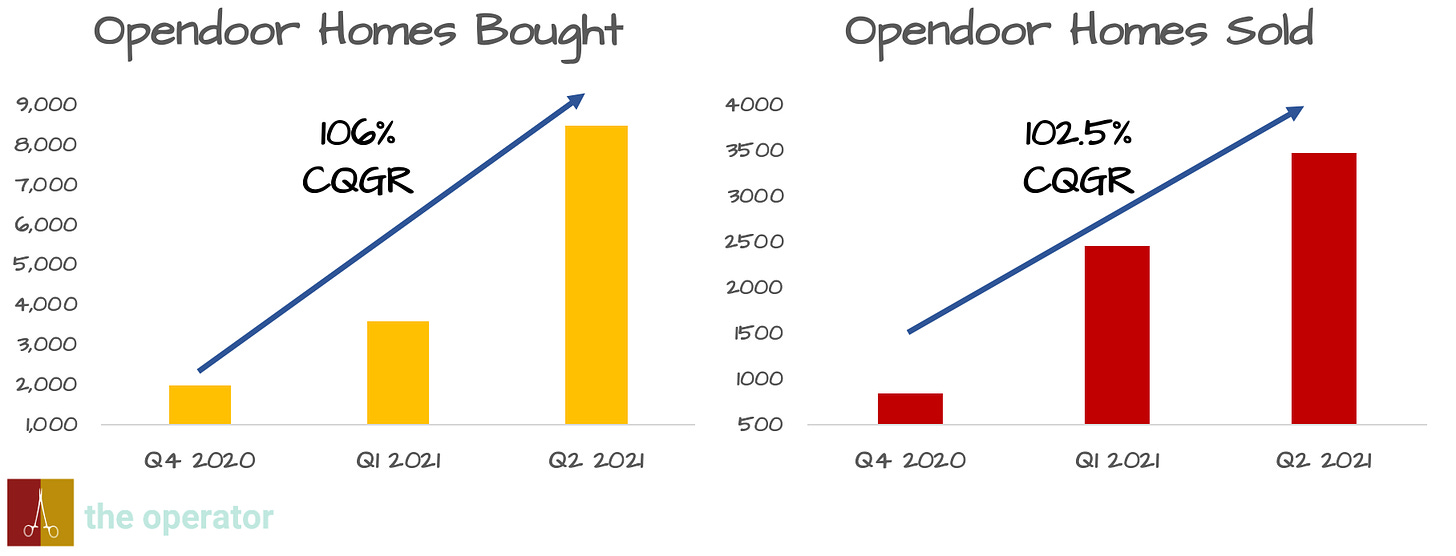

For a business with an endgame as epic as Opendoor, a tremendous amount of scale is required. Although Opendoor has reported only three quarters as a public company, early results demonstrate a blistering cadence.

From a COVID-mangled nadir in Q4 2020, Opendoor has grown home acquisitions and sales with an almost military efficiency.

*CQGR: Compound QUARTERLY Growth Rate

This is triple digit quarterly growth, by the way. Revenue has followed in kind, with Q2 numbers 376% higher than Q4. Take a second to read that again. I have never heard of a company scaling operations this quickly.

“As we enter 2021, I feel like we’ve been building Opendoor for many years behind the scenes for this very moment.”

Eric Wu, Q4 2020 Earnings Call

Wu did not hibernate away the COVID winter, instead he spent it building. In the words of enigmatic Stripe CEO Patrick Collison (who described a similar period of quiet building to some of my Stanford colleagues a few years back), “When you come out of [that period], if you do it well, then stand back.”

Stand back? More like get out of the goddamn way.

Opendoor emerged from the placidity of 2020 stronger than ever. The Q2 numbers exceeded expectations on both the top and bottom lines, and Opendoor somehow remained the fastest growing and most profitable iBuyer per home sold.

iBuyer Q2 2021 Tale of The Tape

*Net Loss excludes stock based compensation

Perhaps most impressively, Opendoor’s guidance for the remainder of the year confirmed H1 2021’s success was no fluke.

“Based on our current progress, our second half revenue run rate is on track to exceed our 2023 target, a full two years ahead of plan.”

Eric Wu, Q2 2021 Earnings Call

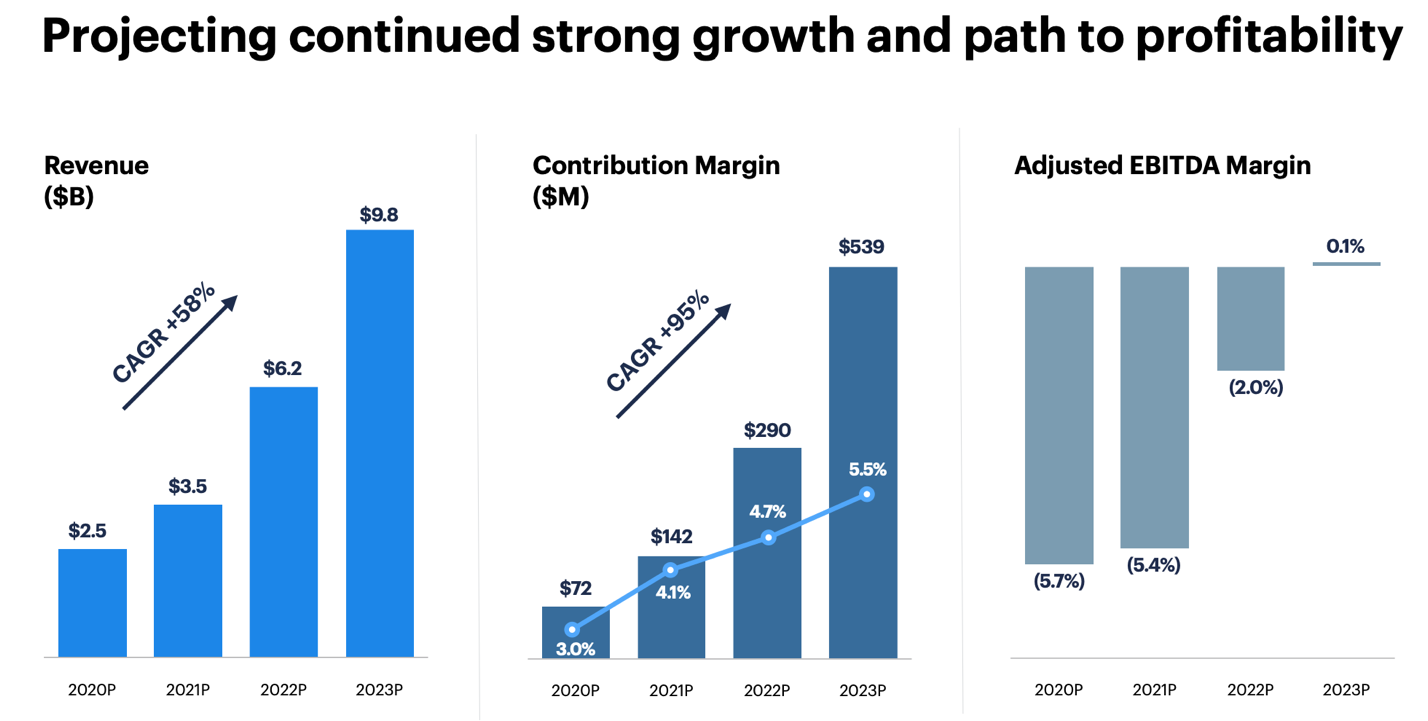

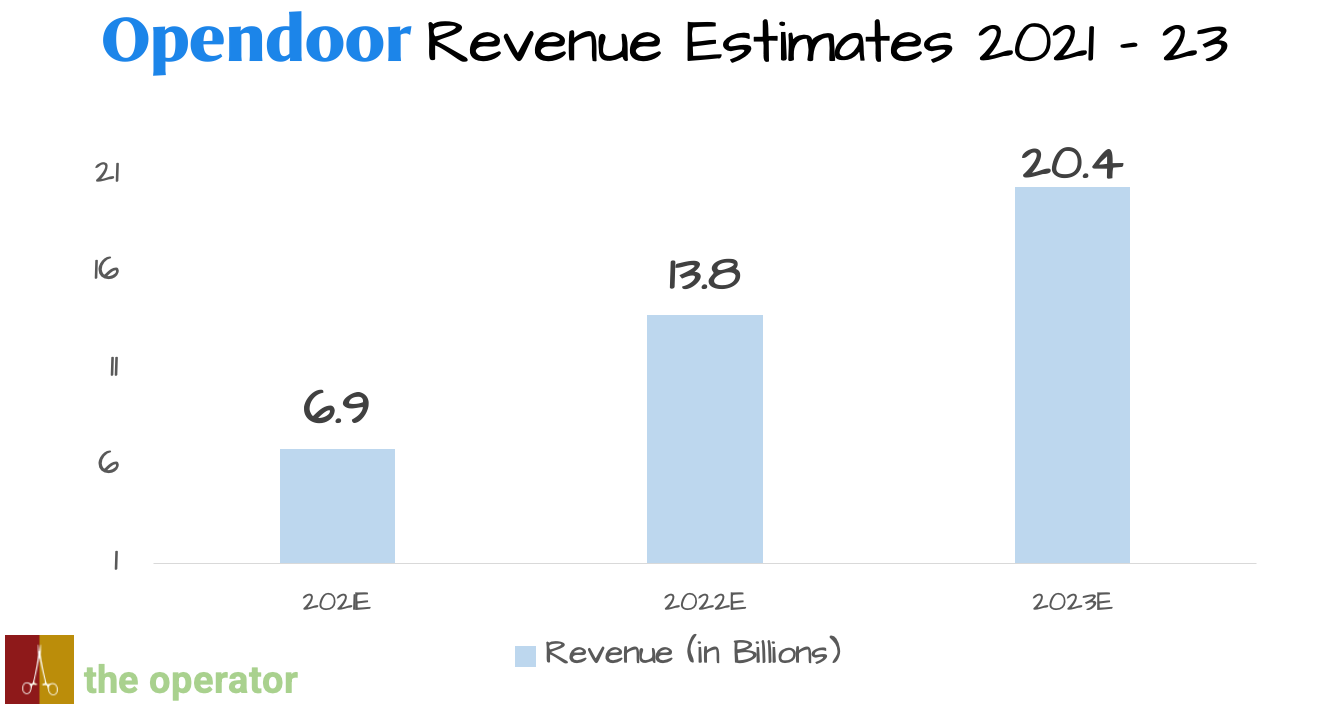

Okay, let’s back up. Below is Opendoor’s September 2020 investor presentation, where management guided for 2021 revenues of $3.5 Billion, and 2023 revenues of $9.8 Billion.

Opendoor’s 2020 Investor Presentation

Nearly 3X growth in two years is what originally drew me to look at the stock in the first place. But on the Q2 earnings call, Wu basically said the company hopped in a time machine and teleported two years into the future.

Q2 guidance indicated 2021E revenue of ~ $7 Billion, a full doubling from guidance given only 7 months ago.

Uh…what?

When was the last time you heard a company double their revenue targets on an earnings call? How about the number of times you’ve heard a company declare they are operationally two years ahead of schedule?

No times, that’s how many.

And CFO Carrie Wheeler was sure to make clear that profitability followed revenue growth.

“We've effectively pulled forward our financial plan by two years on both the top and bottom lines.

Carrie Wheeler, CFO Opendoor, Q2 2021 Earnings Call

2023 was to be the year Opendoor broke even. But based on revised guidance, Opendoor expects to turn a profit over the next twelve months.

As a consequence of the lights-out earnings call, Opendoor rocketed 25% higher in aftermarket trading, and price targets (PT) were revised sharply higher by the smattering of analysts who cover the stock. Opendoor was raised to a PT of $42/share at KeyBanc (upside of nearly 200%) and was added to Wedbush’s Best Ideas List. However, within a few days, Opendoor fell back to recent lows on announcement of a secondary covered call offering. This added $850 million to the balance sheet, for a total of $2.65 Billion in cash and $4.3 Billion across non-recourse asset-backed facilities.

Personally, I took this announcement as a positive; a bigger war chest for blitzscaling, triple-digit quarterly growth. But the market punished Opendoor to the tune of a 23% decline.

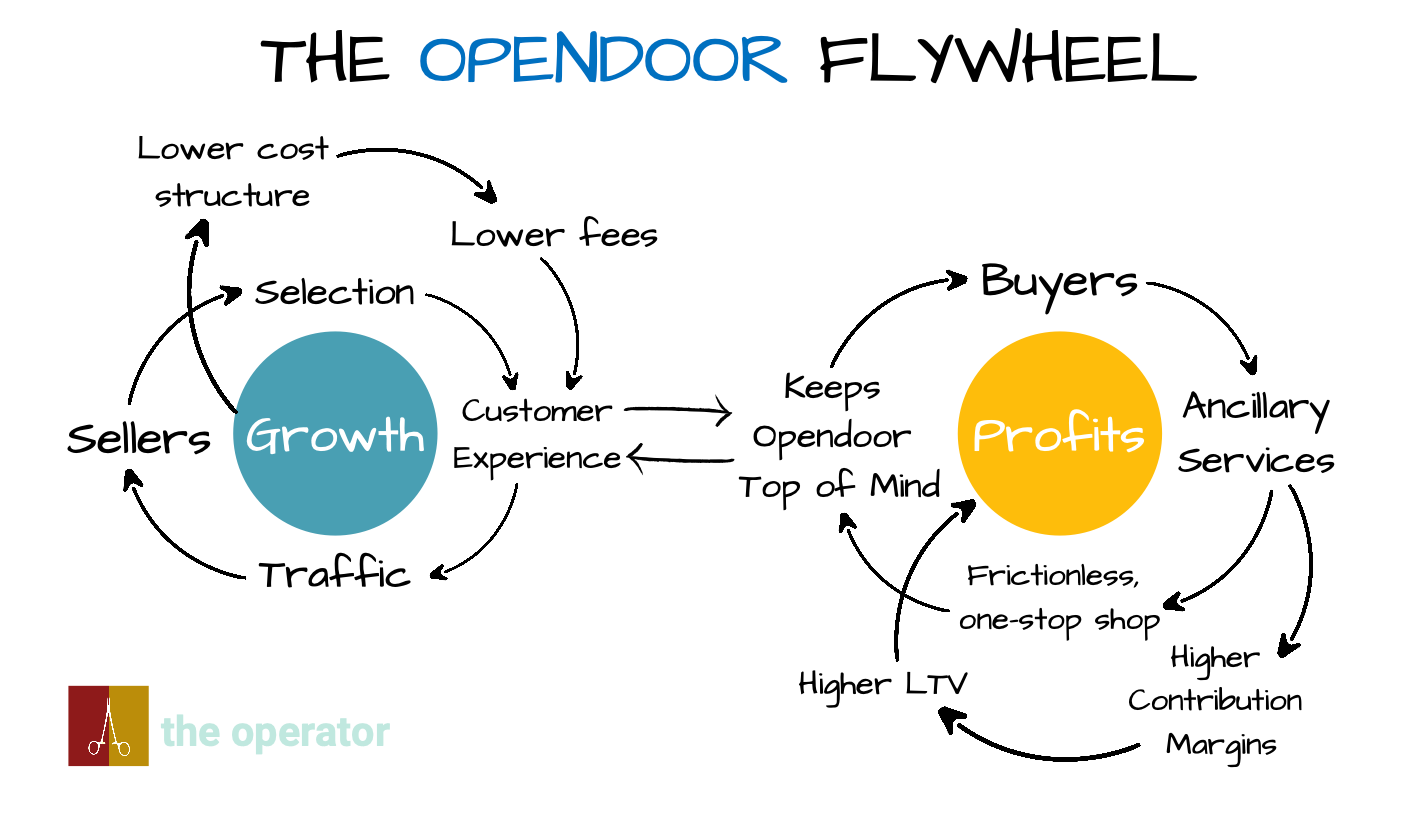

It was this very nonsensical price action that compelled me to write today’s article. And I began by going back to the fundamentals, sketching out Opendoor’s flywheel.

The Mythology Of Flywheels

I’m fascinated with the concept of a self-reinforcing loop. In medicine we call this ‘positive reinforcement,’ best embodied, I believe, by the phenomenon of childbirth.

Stay with me here.

Normal hormonal loops are governed by ‘negative reinforcement,’ ie, if you eat a hamburger your sugar goes up, you release insulin to drive sugar down. Once the sugar is down, insulin release stops. That’s negative reinforcement. 99% of our physiology runs according to this model.

But in childbirth, that cycle is flipped.

Labor commences with a release of oxytocin, the hormone that drives contractions (amongst other important functions). Paradoxically, in labor, oxytocin release stimulates oxytocin release, contractions become stronger; they summate and build and crescendo. The cycle accelerates until the contraction is strong enough for delivery.

This concept of positive reinforcement also exists in the business world. In his seminal 2001 book, Good to Great, Jim Collins first introduced the ‘Flywheel Effect,’ a self-reinforcing loop named after a massive industrial disk. Flywheels take a tremendous amount of effort to spin, but once they do, they seemingly generate their own momentum. If a business could develop such a strategic model it would confer a remarkable competitive advantage.

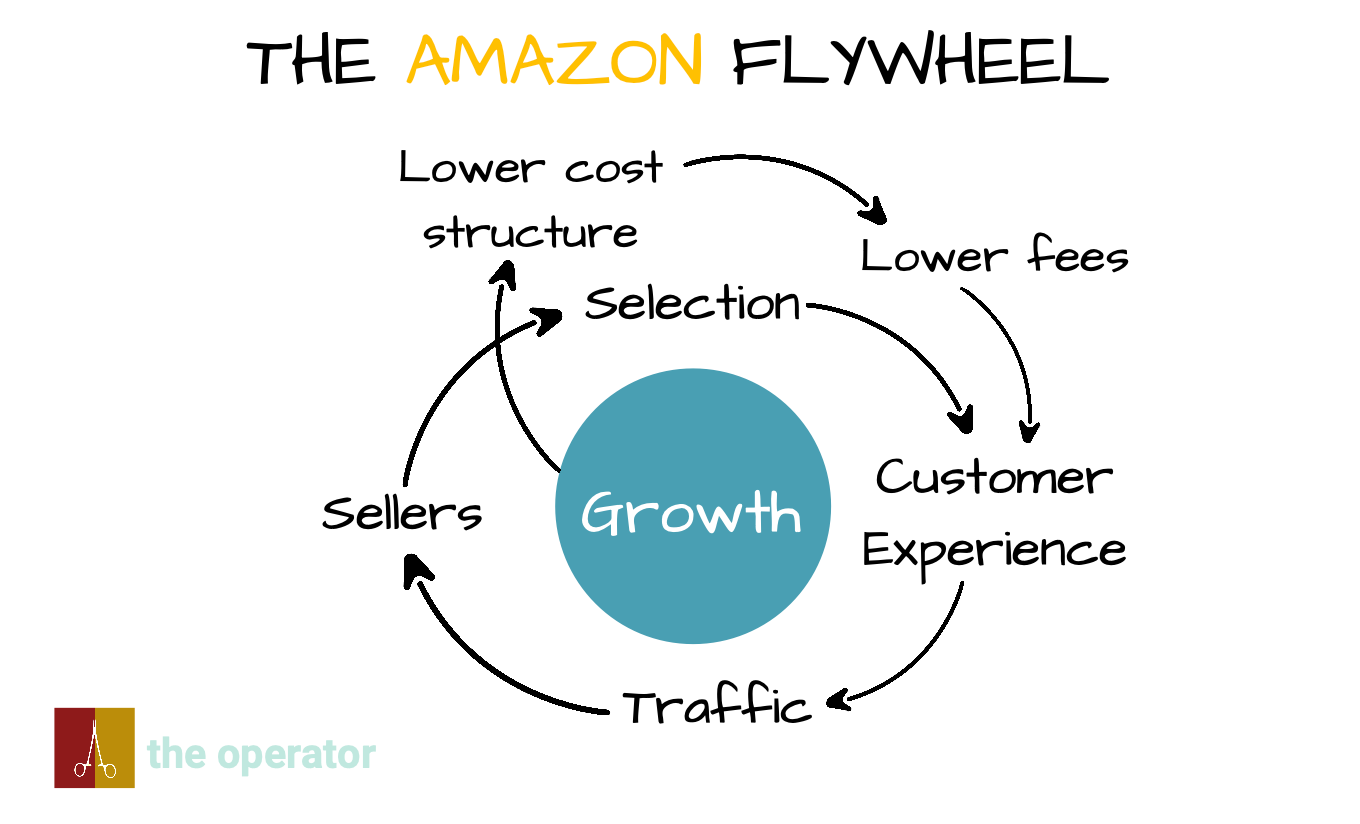

As a case study in flywheels, Collins points to a particularly storied piece of tech mythology. Legend has it that in 2001, Amazon founder Jeff Bezos sat down with his lieutenants and sketched out Amazon’s virtuous cycle (on a napkin, no less). It looked something like this:

Source: me, plus Good to Great

“Lower prices led to more customer visits. More customers increased the volume of sales and attracted more commission-paying third-party sellers to the site.

This greater efficiency then enabled it to lower prices further. Feed any part of this flywheel, they reasoned, and it should accelerate the loop.

Source: Brad Stone, The Everything Store

This is the economic flywheel that arguably changed our modern world more than any other. Bezos’ obsessive focus on customer and cost drove a self-reinforcing cycle, each step accelerating the next. It is a business in complete harmony.

The more I looked into the “Sell with Opendoor” ecosystem, the more I saw characteristics of Amazon’s flywheel. Chamath Palihapitya, early Facebook exec, SPAC king, and the man who helped take Opendoor public, also saw these similarities.

As more homes are sold to Opendoor, the AVM is refined, expanding the Buybox (range of home prices Opendoor can buy), allowing for more market launches, more selection. As valuation improves and the process becomes more streamlined, customer experience (NPS) rises, driving increased traffic. Meanwhile, scale is levered in, and costs as a proportion of business decrease, driving lower prices, benefiting the customer experience.

I have previously written about the flywheels of Palantir (Foundry), SoFi (Financial Services Productivity Loop), and Square (Seller and CashApp, newly joined by Afterpay). Flywheels are rare, and these dynamics, like moats, are tough to both build and spin. But once the rotation begins, a flywheel confers tremendous advantages. The Opendoor of 2020 borrowed the Amazon seller flywheel, setting the stage for the absurd growth we are witnessing in 2021.

But after listening to the Q2 earnings call, it left me wondering if my initial assessments were accurate — perhaps Chamath and I were only seeing half of Opendoor’s virtuous cycle. On the call, Wu spoke about the seller ecosystem, yes, but he also began to emphasize the buyer ecosystem, which is notably absent from the Amazon model.

“We continue to see significant growth of our Buy with Opendoor product. With the recent addition of Opendoor Backed Offers, experiencing rapid adoption since launch less than six months ago. We are excited to share that our Buy with Opendoor product has crossed the $1 billion run rate and we'll continue to grow and scale at a rapid pace. This is a great example of the speed in which we are able to innovate to meet consumer demand on top of our platform.

Lastly, we know that 65% of sellers are also buyers. So we are integrating our products into one bundled experience. We're adding Buy with Opendoor for each of our sellers, also looking to buy and bundling title, escrow and home loans to make the transaction completely seamless and low cost.”

Eric Wu, Opendoor CEO and Co-Founder, Q2 2021 Earnings Call, emphasis mine

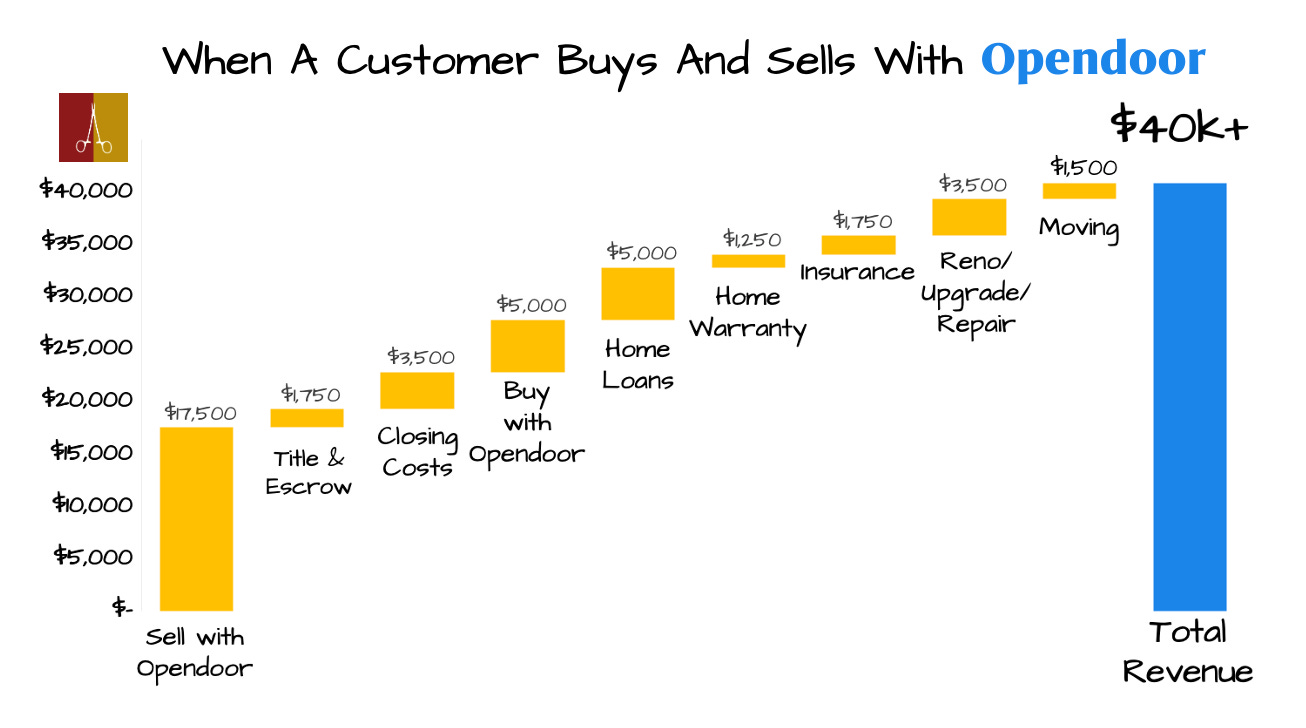

Opendoor is building the infrastructure to be the toll collector at each aspect of the real estate transaction; vertically integrated to create a seamless customer experience.

The seller business is all about transactions; harvesting a 5% fee, and the game is won by selling as many homes as possible. This is the growth flywheel.

But the buyer business is a different breed altogether. Only in the buyer ecosystem can Opendoor attach the highly profitable ancillary services such as mortgages, loans, home maintenance, insurance, warranty, upgrades and moving services. These are high-margin digital services easily bolted onto the buying process. This is the profitability flywheel.

The high profitability of the buyer ecosystem is being aggressively targeted by power buyer start-ups such as Reali, Homeward, HomeLight, Knock and Orchard. By being involved exclusively in the home buying process, these power buyers enjoy ancillary attach rates north of 70%. Opendoor and Zillow, masters of the seller ecosystem, report attach rates around 2% and 1%, respectively. After all, if you’re selling your home, you probably don’t need a mortgage. If you’re buying a home, on the other hand…

The profitability characteristics of the buyer ecosystem represents a key strategic milestone. This is how Opendoor doubles its contribution margin.

The above diagram demonstrates the full breadth of the real estate racket. By being a vertically integrated, full-stack solution, Opendoor can offer each of these services to the customer looking to both buy and sell. Assuming a home price of $350k, ancillary services and fees add up to over $40k, or 11+% per home sale. And this figure does not include home price appreciation, increase in renovation value, etc.

In this context, Opendoor’s seller ecosystem is a Trojan horse, the wedge used to carve out a dominant position within the high walled fortress of real estate transactions.

And Eric Wu is leading the siege from within, capturing impressive market share from both the buyer and seller ecosystems. Accordingly, Amazon’s flywheel model tells an incomplete story.

Opendoor actually has two flywheels, which combine like this:

Source: me

This is not a virtuous cycle, it is an ouroboros; an infinite loop of the real estate transaction, where sellers become buyers and buyers become sellers. Opendoor has substituted itself at each step, replacing undisrupted intermediaries with frictionless offerings that are both cheaper and faster.

I challenge you to name another business building such expansive infrastructure. These two ecosystems, growth counterbalanced by profits, are just beginning to spin against each other, and represent the birth of a new real estate dynasty.

What Happens If Opendoor Wins?

But what happens if the bull case plays out? What does the world look like if Opendoor wins? Let’s start with the near term, forecasting revised revenues for 2021, 2022, and 2023.

Source: me

As a reference point, Opendoor posted 2020 revenue of $2.5B. It is primed to increase revenues by 8X in less than 2 years. That’s just looking out to 2023.

For a company scaling as rapidly as Opendoor into such a vast opportunity, trading at around 0.6x forward revenue seems a bargain. I believe Opendoor should be valued at least at a price to sales (P/S) of 3.

I don't think 3 is unreasonable. It’s actually quite conservative, and takes into account Opendoor’s low-margin business. Compare this to the mountain of other unprofitable tech businesses with much smaller opportunities and P/S multiples in the teens — you’ll find I’m not being overly optimistic. Others like to use more exotic multiples like EV/GP, and that’s fine too, the takehome is this: each metric demonstrates an undervalued business.

Given Opendoor is projecting a Q3 run-rate revenue north of $10 Billion, my 12-month price target is $49/share (assuming 604 million outstanding shares), or upside of 226%). Things start to get really interesting at the two year price target range, as rapid revenue and even faster profitability growth results in almost another doubling from there.

But the market and Wall Street have not exactly come to the same conclusions I have, yet. The price action tells you this, although admittedly Opendoor is up 35% over the length of time it took me to write this, so maybe people are beginning to warm to the opportunity.

I read a tweet recently I think best sums up Opendoor’s current depressed valuation. This goes back to one of my core investment principles about being early — that invaluable asset of being misunderstood.

It is in knowing the truth behind the misjudgment, by ousting the mist of confusion, that we as investors might benefit from misunderstanding. That’s what I endeavor to do here, at least.

Longer term, I see a future in which Opendoor is able to leverage their market leadership into a wider array of ancillary services and opportunities. After all, Amazon was able to turn a high-volume-low-margin business into a behemoth by adding the highly profitable AWS. Perhaps Opendoor enters into the home renting space, allowing highly visible and recurring revenue while they await home appreciation/sale. Perhaps Opendoor builds or acquires a PropTech technology/company that allows subscription software and/or hardware easily installed in each of their homes, such as climate control, security, cameras, etc? If you control the home, you can control the tech inside.

These scenarios seem not only possible, but likely.

Opendoor has already shattered their 2020 playbook by pulling expectations forwards two years; it’s not much of a leap to consider how else Wu and Co will creatively redefine the boundaries of the real estate space. Just last week as I was poring through my research notes I found this on Opendoor’s Glassdoor:

Source: me

Opendoor is expanding internationally.

At no point in Opendoor’s history have they commented on international expansion, but here’s the proof. To give you an idea of the scope of this finding, Toronto and Vancouver combine for a population of 7.7 million people. As of July, the mean home price in Toronto was $850k, and in Vancouver $987k.

Opendoor’s two largest markets, Phoenix and Atlanta, represent a similar population of 7.52 million, but the mean home price in each of these cities is less than half, at $390k. These Canadian cities are therefore more than twice the size of Opendoor’s most successful markets. And there are no iBuyer competitors there.

If Opendoor can successfully launch in Canada and other international metropolitan areas, it would represent blockbuster upside to even the most optimistic forecasts.

Playing The Game Of Prometheus

Between my penchant for science fiction and the sheer scale of disruption happening in the residential real estate space, it’s hard for me not to play ‘what-if,’ to think ahead.

Historically speaking, when a new and promising business model is incepted, dozens of copycat or single-product players spring up around it like mushrooms. Think about the ride-sharing, cannabis, or crypto spaces — you’ll quickly have more examples than you know what to do with. We see that now, with Zillow, Redfin and Offerpad pouring resources into the iBuying space, as well as the myriad start-up power buyers. These periods of industry infancy are characterized by frenetic competition, as well-capitalized upstarts engage in guerrilla-style assaults on the luminary who led them there.

Using these examples as historical lessons, I expect two certainties in the space in the near term: consolidation and marketshare growth.

As we have discussed growth in detail, let’s take a moment to discuss consolidation. Below are the two mergers or acquisitions I believe most likely in the coming years.

Redfin and Offerpad merge

As outlined above, Redfin is woefully outmatched in its AVM, and will likely require billions in tech R&D to achieve prudent unit economics. I doubt they do that.

Redfin still prioritizes realtors, which cuts deeply into their home transaction profits. Offerpad, on the other hand, is currently the most profitable iBuyer (remember, Offerpad doesn’t have to deal with onerous SBC because it remains private, going public this quarter). Regardless, Offerpad is executing rather brilliantly, with decent growth and superb unit economics. Furthermore, the Offerpad team are exceptional allocators, running the leanest ship in the space.

I like Offerpad, a lot actually, and think it will be a good investment. Management has outlined a respectable goal of around $20B in revenues down the line in 48 cities, and should carve out a nice segment of the iBuying space.

That said, Opendoor is where my money is parked.

To paraphrase The Notorious Conor McGregor, ‘Opendoor is not here to take part, they are here to take over.’ As an early investor, I want the visionary, the top of the food-chain, apex predator patiently looking ahead with a thousand-mile stare. Unblinking.

That’s Opendoor.

But a merger between Redfin and Offerpad would be a formidable opponent. Redfin would offer exceptional top-of-funnel and lead-generative competency for Offerpad, not to mention brand recognition. Similarly, Offerpad’s operational culture and AVM could be used to double or triple Redfin’s iBuying margins. Redfin and Offerpad also have little overlap in home demographic — mean home price for Offerpad is $300k whereas Redfin is $550k, which means synergies would hit more cleanly.

The resulting amalgamation would be a mini-Zillow, a notable third-place contender. While such a situation would validate the space and possibly expand multiples, I see this as a negative catalyst for Opendoor, making its profitability contemporary, Offerpad, that much stronger.

Opendoor is acquired by Blackstone or Big Tech

Recent numbers from the iBuyers have made the rounds. From Wall Street to family offices, people are beginning to see the writing on the wall: there is a monstrous opportunity in virtual real estate.

Blackstone and Big Tech are the best capitalized contenders to take marketshare by internalizing Opendoor. Were Prometheus a PE firm, Opendoor would have been bought already.

Blackstone, one of the largest alternative asset investors in the world ($150B market cap), is a major player in the real estate space. Just this past June, Blackstone gobbled up Home Partners of America for $6B. Home Partners buys homes (of which it currently owns 17k), rents them out and offers its tenants the chance to eventually buy. While Blackstone has traditionally focused more on commercial real estate, there are clear synergies here with their internal real estate team, alongside the funds to scale massively into the iBuying category,

I also see a scenario in which Amazon considers acquiring Opendoor. While the synergies are not as barefaced as Blackstone, there may be something there. Amazon, like the rest of Big Tech, is trying to get as much of their hardware and software into our homes. Fulfillment has never been more important, or more expedient. If Amazon was able to participate in home transactions, and outfit each home with an Alexa, Amazon Fire TV and subscription to Amazon Prime, this could be a major coup.

If data is digital oil, the company that controls the operating system of our homes will have a monopoly on the most valuable consumer-facing information in the world.

Amazon has the brand, bank, and an bold new CEO to make this happen.

And then there is the third scenario, and the one I find most likely — that Opendoor is never acquired. Where Wu remains at the helm for the long haul, patiently executing on the singular goal of becoming the category winner in iBuying.

Wu has previously emphasized his intention to ‘never exit,’ or be acquired. And I, an investor able to marry the company with the thesis, hope is he right. While Opendoor might acquire rivals or subsegment winners to expand offerings, it wouldn’t surprise me to see continued in-house build. I welcome each, as I have found the leadership team exemplary capital allocators.

Closing Thoughts

As Opendoor continues its conquest of the residential real estate sector, it charts a bold new course, the very tip of the spear. Over the next few years I expect Wu and his team to entirely reimagine this nascent industry, as the opportunities to revolutionize our homes with data and technology are incredibly under-capitalized. And I see no reason why iBuying will not claim 25 - 30% of the home buying and selling transactions over the next 10 years, with Opendoor owning the majority.

I for one cannot wait to watch Opendoor’s legend unfold.

Thank you for sticking with me throughout this article, for learning how the misunderstanding of Opendoor can be our benefit, and for playing the game of Prometheus with me. I can only write these articles in stolen moments and because I love doing it - the learning, the research, and most importantly, interacting with you. If you have a company you think needs a closer look or a deeper dive, please reach out to me on any media. I can always talk business.

Stay convicted.

Tyler

Special thanks to Jennifer for again demonstrating extreme patience with my extended writing sessions, and for helping create a masterful series of figures for this post. Special thanks to you, reader, if you click any of the below buttons.

This is the best DD article I have ever read...Thank you. I own OPEN, Z and RDFN. The only thing that worried me about OPEN was choosing to go the SPAC route. Of all the decks I have of companies choosing the SPAC financing, the insiders get rich on the front end at the expense of the market. Honestly, I have not read the prospectus on OPEN, I am only making assumptions based personal bias. Though financial variables will shift, this middleman model needs to be gutted because it is costly and time consuming. This is AMZN style disruption. Personally, I would take a 10% hit on the price of my house JUST to move it quickly.

This is excellent. I guess your $6.0 mm in incremental interest = 300K * 20% equity * 10,000 per quarter; actually not sure I understand how you got incremental interest from the equity ... but I think the bigger question (surprised I haven't seen this, I will take a look at their 10K) is their overall return on capital. If I see their ROC (e.g., EVA) is durable, then I think it's a buy for me. This is a capital intensive business so I think that's the piece this missing in the argument. But THANK YOU for OPENing my eyes to OPEN, great job here. I will be reading this twice.