Welcome to the 28 new and curious minds who have joined The Operator since July 1! If you are reading this but have not subscribed, join the 135 others by subscribing here!

It just feels good to be back writing about Palantir again.

What’s not to like – LoTR references, a misunderstood business model and visionary leadership levering big bets and bold ambitions. And be you bear or bull, we are all here for the cafeteria-style food fight that inevitably ensues.

Palantir’s polarizing coverage has been a lightning rod for financial authors and individual investors alike. Since my first article on Palantir six weeks ago there have been no less than 38 Seeking Alpha articles published on this high-touch enterprise software company, despite nonexistent interim earnings or M&A.

And yet there is still much left unsaid.

Much remains misunderstood, many hand-wringing bears require further edification. I take up this timeworn task with a restrained fidelity, my pen my sword, my wit my shield.

Let’s get to it.

I want you to imagine what it would be like to have your senses fail you. If your eyes omitted data, told an incomplete story, or flat-out lied to you. If you couldn’t accurately identify temperature, depth perception, or the direction of a sound, what mistakes might you make? Being forced to navigate inconsistent data streams is akin to flying blind. It’s error prone, and dangerous.

Now extrapolate those perils to a larger organism. An enterprise, perhaps, built of many people, with many stakeholders, technology and processes – what hazards might menace today’s enterprise armed with poor data infrastructure?

Palantir recently tweeted “Poor data, poor decisions.”

In reply to such a statement we nod dumbly. But I’d wager each of us still observes an incomplete picture of Foundry’s functionality for the modern business. And what is the modern business? Are you imagining a bootstrapped side hustle or a sprawling conglomerate? We easily intuit Palantir’s role in large enterprise, but have we acknowledged what the world might look like if Foundry achieved incandescent product market fit with companies of all scale: Foundry for all?

Big data is not only for big companies.

Those are Palantir’s words I’m borrowing. In the present article I make the case Palantir’s TAM is expanding, secretly, quietly, ever so inevitably – before our very eyes. Underpinning recent announcements and SPAC investments exists a critical thread of truth I intend to unravel and track. This observation radically widens the aperture of the investment thesis, and is a snapshot of a leadership team building the most important company in the world.

Read on.

Foundry for Builders

On July 20, 2021, Palantir introduced Foundry for Builders, an initiative “dedicated to supporting early-stage companies by providing them with the Palantir Foundry Platform.”

In the announcement, Palantir listed five start-ups connected to Palantir alumni, the inaugural Foundry for Builders cohort, class of 2021:

Chapter, a New York-based company that helps customers understand and select Medicare plans

Hence AI, based in London, which uses AI to help companies make better relationship decisions in the legal and consulting industries

Adyton, a Scottsdale-based builder of mobile software that links users in the field with enterprise systems

A fintech company based in Oslo, Norway, that aims to simplify B2B transactions by offering a buy now, pay later alternative (BNPL)

Gecko Robotics, a Pittsburgh-based maker of robots used for industrial inspections

(Aside – although the Oslo based BNPL company was not listed by name, we can probably figure it out. After a quick search I discovered Tillit, an Oslo-based pre-product BNPL company that just raised $2.5 million in a seed round led by Sequoia. The co-founder and CCO is Edward Brandler, who describes himself on Linked In as “Ex-Palantir, Ex-Gurkha Infantry Officer, Speaks 6 European and South Asian languages, Has a small dog.” Add “Tillit” to the list.)

For some, reading the Foundry for Builders headline resulted in an anticlimactic, “huh, that’s not gonna move the needle,” and quick digital 180 to better marketed click-bait. But not me. When I read this I latched on like a robotic gecko, my own entrepreneurial flame ignited. What did I see?

Palantir is putting Foundry for small business in beta.

Get that tattooed somewhere Memento-style so you don’t forget it.

This is a gamechanger. Say goodbye to 6 - 12 month sales cycles and millions in set-up costs. Palantir is building an out-of-the-box, 0 to 1, Foundry product, simplified, cleaner, for the less complex organism: small business.

Unit economics prevail in this model. The Foundry for Builders sales cycle (Expand and Scale) will look much like the Foundry sales cycle, minus the costly and time-intensive ‘Acquire’ phase. Foundry for Builders will mature alongside these small businesses, benefiting from battle-tested data and enterprise insights. And as use cases inevitably multiply, Foundry plays the accommodating innkeeper, murmuring, “yes, we can do that too.”

These small businesses will benefit from a defensive advantage observed traditionally in much larger enterprises: the Process Power Moat. In my article outlining Palantir’s seven moats, I wrote the following:

“Perhaps Palantir’s greatest strategic advantage is that its products offer the Process Power moat to its customers.

Said another way, Foundry and Gotham allow customers to build their own Process Power moat. If you are a Fortune 100 company using Palantir, your lead over competitors widens as your supply chains achieve resonance, inefficiencies are trimmed and the product roadmap slope goes vertical. Palantir's software allows customers to look into the very seeing stone it was named for.”

Imagine the advantages a start up might gain with Foundry onboard. Palantir is granting small businesses the same tech used for war games, space simulation, and public health crises.

The many insights gleaned from a wider range of small business models will allow Palantir to ruthlessly whittle Foundry for Builders down to the most economical, aerodynamic, chassis-and-motor, product. These leaner learnings may then be passed upmarket to generate savings on enterprise software deployments.

This sounds like the stuff of flywheels to me.

Source: Jennifer and I

And the product could not come at a better time. In the face and the wake of COVID-19, the USA has witnessed a record number of small business applications. If 2021 was the rise of the side hustle, Foundry for Builders could herald a renaissance of entrepreneurship, a gilded age of innovation.

It’s challenging for me to point to another business announcement more bullish, or more patriotic. This is part of what Karp means when he says Palantir will be the most important company in the world – continued expansion into these critical vectors.

And for those of you twitchy skeptics doubting whether Foundry for Builders can result in meaningful revenue, look no further than Square or Shopify. There are over 30 million small businesses in the USA today, and that number is not just growing, it is accelerating. Those under-motivated employees who developed an allergy to office life are levering lingering stares at the frictionless dashboards of Wordpress, or Etsy, economically cushioned by increased discretionary savings.

Source: me, with help from Census.gov

If Palantir were to capture 2% of this small business market, charging $50k – 100k per customer, the revenue opportunity in the USA alone is $30 – 60 Billion. And I estimate the unit economics of this offering at scale are superior even to Palantir’s enterprise contracts, similar to high-margin licensing fees with more rapid pay-back periods.

Are you beginning to see the investment thesis?

Palantir’s Dozen SPACs: Not Slowing Down

Let’s pivot for a moment from Foundry for Builders (we’ll come back to this) to Palantir’s SPAC investments. Since my first article on Palantir’s SPACs, Palantir has continued to aggressively invest, adding another six to the bullpen. Given this behavior, in addition to the Foundry for Builders announcement, I think we can say, with confidence (altogether now), Palantir is expanding downmarket.

Below I have tabled Palantir’s dozen SPACs, and what follows are mini-dives into each of the new investments: Boxed, Pear Therapeutics, Tritium, AdTheorent, Kredivo and Fast Radius. I outlined these investments in no particular order, but I may comment on which of these businesses I would be an investor in.

Palantir SPAC’s I - VI

Palantir SPAC’s VII - XII

Boxed: Costco for Millennials

Boxed is an e-commerce platform founded in 2013 selling bulk, high-repeat essentials to individual consumers and businesses alike. Boxed expects to merge with Seven Oaks Acquisition Corp (SVOK) in Q4, 2021, with a pro-forma enterprise value of $640 million.

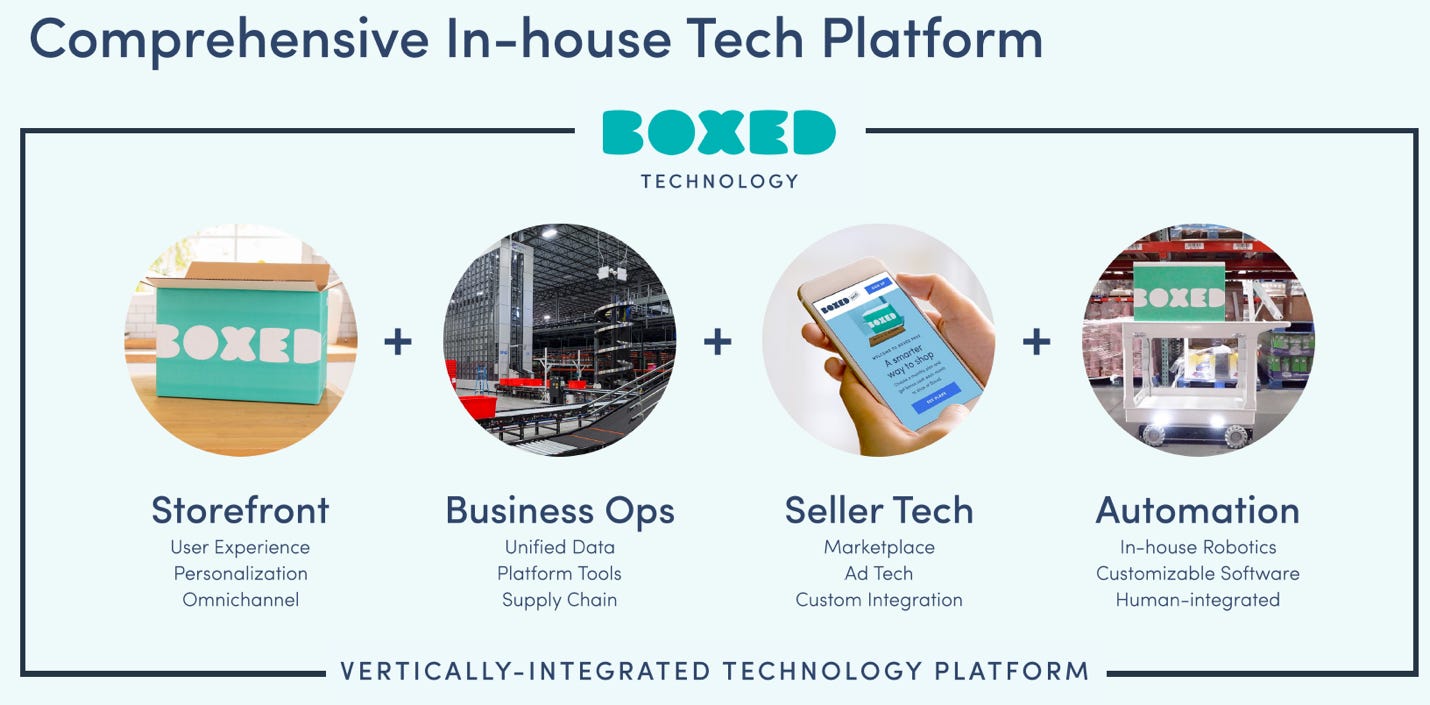

Source: Boxed Investor Presentation

Boxed is the full stack of e-commerce technology, including storefront, supply chain, marketplace and advertising, as well as fulfillment and proprietary robotics. We can roughly divide Boxed’s business segments into B2C, B2B and software.

Boxed: Business to Consumer (B2C)

Boxed’s customers are millennial females by majority, which is the literal mother of all demographics. CEO Chieh Huang is targeting the $106 Billion online grocery market by simplifying the mobile experience and making fulfillment a delight.

When Boxed orders are fulfilled, the boxes arrive in easy-on-the-eyes pastel tones, bubbly font, and each comes with a selfie of your order.

#instagrammablemoment #boxedselfie

Source: Boxed Investor Presentation

As someone who is a student of sales and marketing savoir faire, Boxed is a master class in the soft nuance of e-commerce. Delighting customers with fulfillment drives conversion and repeat sales, and actually makes what’s inside the box more enjoyable. Accordingly, Boxed boasts an NPS of 69 (higher than Amazon, Apple and Netflix).

By harnessing machine learning, Boxed is able to estimate when customers might run out of products, and will recommend these options with, “Need These Now” notifications. If Boxed guessed correctly, customers can tap or click for checkout. I see a long runway of growth here, with heavy category drivers such as Pet and Drinks (I see you, seltzer).

Boxed: Business to Business (B2B)

Boxed’s B2B solution targets office buildings and airlines like United, and was hit hard by COVID lockdowns. However, Boxed projects a rapid rebound in 2022, forecasting a B2B CAGR of 56% through 2026.

Boxed’s B2B ML solution, Concierge, builds on the predictive shopping stack with autonomous fulfillment when business’ supplies are presumed low. Currently, Boxed has fulfillment centers in New Jersey, Nevada and Texas, allowing for orders to be delivered within 2 days.

Boxed: Retail SaaS Software

Boxed’s software division is a white label omnichannel solution vertically integrated for retailers. In August of 2018, Boxed received $111 million in series D funding from Aeon Group, a massive 263-year old Japanese retailer. In addition to this investment, Boxed and Aeon signed a deal to develop a proprietary e-commerce network, end-to-end, in Malaysia.

"So it's the website, mobile app, inventory management, robots, warehouse management, the CRM system, all of it. So in essence, anyone theoretically wanting to get started in e-commerce or revamping their e-commerce can make one phone call and have a white label version of what we built set up pretty quickly for them.”

Chieh Huang, Boxed Co-Founder and CEO

While this software segment constitutes only $12 million of Boxed’s 2021 revenue, Boxed believes this will rise to $106 million by 2026. Furthermore, the high margin SaaS revenue will drive a full doubling of Boxed’s gross margins from 15% today to 30% in 2026.

I see multiple areas Foundry could be used to enhance Boxed’s offerings. Supply chain logistics, Concierge and predictive shopping optimization, fulfillment and robotics analytics each represent potential use cases. Furthermore, I believe a partnership with Boxed grants Foundry advanced omnichannel commerce insights.

Pear Therapeutics: Prescription Software

Pear Therapeutics is a first-of-its-kind pharmaceutical company offering prescription digital therapeutics (PDTs), or said more cleanly, prescription software.

Yes, you read that right.

Pear received FDA authorization for three products, reSET, reSET-O, and Somryst, which treat non-opiate substance addiction (alcohol, stimulants, etc), opiate addiction, and insomnia, respectively. Pear intends to merge with Thimble Point Acquisition Corp (THMA) later this year for a pro forma enterprise value of $1.2 Billion. Legendary Japanese VC Softbank is a notable backer alongside Palantir.

Source: Pear Therapeutics Investor Presentation

Digital therapeutics represent a fascinating convergence of technology and medicine, with Pear’s offerings blending app-based cognitive behavioral therapy (CBT), fluency training, contingency management, and craving/trigger assessments with a clinician-connected telemedicine platform.

The resulting alloy is a fascinating composite of software-like margins and therapeutic-like pricing. PDT’s could increase value-based-care (I see you, Babylon (KURI)) by providing similar utility as a medication, minus a laundry list of side effects, and can be used in conjunction with traditional pharmaceuticals to make the latter more efficacious. Furthermore, these adjunctive prescriptions can help prevent expensive emergency medicine and relapse care.

Pear currently has 14 product candidates in various developmental states, but the range of addressable diseases is vast, including those listed in the above figure. While Pear anticipates only $4 million in sales this year, they forecast a tremendous 459% CAGR over the next two years to $125 million in 2023.

And the early data are compelling.

In addiction medicine, what we care about most is persistent abstinence. In a large clinical trial, reSET improved abstinence by a factor of two, with 88% of patients abstinent at 12 weeks (reSET was administered in addition to standard of care, and was not evaluated as a standalone therapy).

As a personal note, reading about Pear’s addiction therapies hit a bit too close to home. A loved one of mine struggles desperately with addiction. It has submarined relationships, devastated those around them, and has failed in the face of herculean family efforts, oral and IM medications and rehabilitation stints.

I love the idea of using a digital and clinician-validated platform for daily progress and therapy as an adjuvant to traditional pharmaceuticals. While preparing this article I reached out to a friend who completed the Harvard Addiction Medicine fellowship to get their take on Pear. Fortunately, they saw Pear’s virtual presentation at the American Academy of Addiction Medicine and felt reSET was a great way to keep patients engaged and in communication with their care. It is something I may therefore look into.

Pear’s clinical trials and discovery will benefit from Foundry’s more robust data analytics platforms. Most importantly, unlike traditional pharmaceuticals, Pear’s therapeutics improve with higher quality and quantity data. Foundry therefore represents an ideal platform for Pear and the prescription software model.

Tritium: The Fast Charging EV Revolution

“You have to match the convenience of the gasoline car in order for people to buy an electric car.”

Elon Musk, CEO Tesla, SpaceX, The Boring Company, OpenAI, and Neuralink, card-carrying member of the PayPal mafia

Tritium is a DCFC ‘Direct Current Fast Charging’ company, fashioning itself as the infrastructure leader in the EV movement. Tritium is currently the only pure play in this space, expected to merge with Decarbonization Plus Acquisition Corporation II (DCRN) later this year for a pro forma enterprise value of $1.4 Billion.

Although not a pharmaceutical company, Tritium aims to address a disease plaguing the EV revolution: range anxiety.

One of the prime frustrations of replacing an ICE vehicle with EV is a poor charging experience. Traditional alternating current chargers can take 47 – 91 minutes to add 20 miles of range. This is not tenable – and can limit EV driving to short, defined trips with known charging points. Via Tritium’s 350 kW charger, however, it takes 1 minute to add 20 miles of charge, or roughly 20 minutes to fill up.

Tritium’s value proposition is clear.

Source: Tritium Investor Presentation

Notably, charging market growth is expected to outpace EV adoption, and over the next five years Tritium anticipates global EV charging hardware sales to rise by 1566% to $50 Billion. Tritium has engaged strategic partnerships with a host of blue-chip international customers, and is the only liquid cooled, IP65-rated charger technology on the market. Excluding Tesla, Tritium boasts 15%, 20%, and >75% market share in North America, Europe and Australia/New Zealand, respectively.

Tritium sees three forms of revenue – hardware (charger revenue), software, and services. Hardware involves charger sales (gas stations, charging stations, offices, apartment buildings, etc). Software revenue encompasses subscription to Tritium Pulse, a charger management platform that provides analytics (from the Tritium Data Lake), grid management, connectivity packages, and on screen marketing and advertising. Services revenue includes asset maintenance and commissioning.

Source: Tritium Investor Presentation (Note: there are some labeling errors on this graph, but it remains interpretable)

Tritium forecasts revenue growth of 18X from today’s levels to $1.5 Billion in 2026, and free cash flow positivity by 2023. Growth in the USA will galvanize these estimates – President Biden pledged to build 500k new chargers over the next decade, and to convert the entire government fleet of ~650k vehicles to electric.

I see numerous ways Foundry can jumpstart Tritium’s growth. Tritium’s investor presentation is riddled with references to their data superiority – vocabulary commonplace for Palantir, but less so for an electric charging company. Tritium appears to be intensely focused on the connectivity of its chargers, building a network powered by utilization insights, UX interaction data, and vehicle and grid trends. These data are then sent back to customers in a single, visible dashboard, allowing for SaaS-like subscription insights. Nobody executes this data visualization model better than Palantir, and Foundry will be able to identify and optimize new use cases and grid chokepoints.

AdTheorent: This Product is not Sticky, it’s Adherent

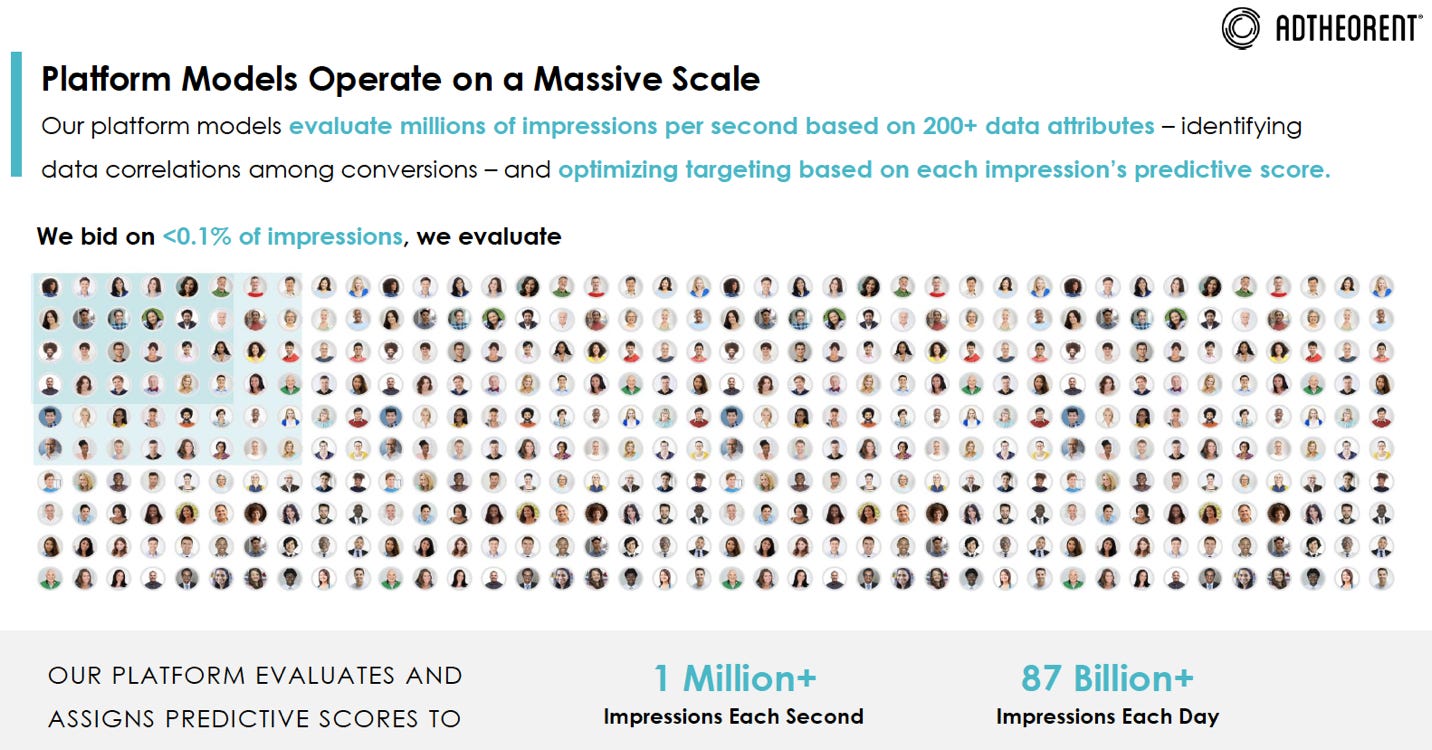

AdTheorent is a data science and machine-learning platform for performance digital advertising. It intends to merge with Monroe Capital Acquisition Corporation (MCAP) later this year at an enterprise value of $775 million.

AdTheorent’s differentiated business benefits from tectonic shifts towards performance-based, privacy-compliant advertising solutions. The de facto ad targeting methods (cookie-based retargeting and segment-based audience targeting) are out of step with privacy regulations and suffer poor performance because they are driven by poor data.

AdTheorent drives eyeballs to campaigns a bit differently.

Source: AdTheorent Investor Presentation

By collecting over 200 non-sensitive data signals from a given consumer, and harnessing ML to evaluate millions of impressions per second, AdTheorent is not afflicted by the pathologies of incumbent advertisers.

I want to double-tap the term ‘non-sensitive data signals’ here – AdTheorent’s many collected data attributes are not personally identifiable. Rather, AdTheorent uses information such as what city a consumer is in and the temperature at the time they logged on, what type of phone they are using, and which browser, etc.

In an era of ever increasing concerns regarding how Big Tech profits from our ostensibly private data, AdTheorent stands, arms interlocked with Palantir as a responsible data company. While other industry players are developing cookie alternatives to maintain market share, AdTheorent already operates with privacy-forward solutions.

Accordingly, AdTheorent customers are the most sophisticated advertisers in the world, including AbbVie, Sanofi, McDonalds and Capital One. AdTheorent’s obsession with privacy-friendly solutions has allowed rapid growth in two particular verticals where data security is paramount: Healthcare/Pharmaceutical ((HP)) and Banking, Financial Services and Insurance ((BSFI)).

AdTheorent anticipates $102 million in 2021 revenue ex-TAC, of which $83 million is gross profit with 30% adjusted EBITDA margins. Using a CAGR of 28%, AdTheorent forecasts 2023 revenues of $167 million.

In many ways, AdTheorent’s responsible data mission and product are quite similar to Palantir’s, and their partnership makes a good deal of sense. I will highlight several potential collaborations in the closing chapter as well.

Kredivo: Indonesia’s Afterpay

Kredivo is the rapidly growing Buy Now Pay Later (BNPL) leader in Indonesia, expected to merge with Victory Park Capital (VCPB) for a pro forma enterprise value of $2 Billion.

Kredivo drives 2-3% of Indonesia’s e-commerce GMV, representing the largest credit payment channel after traditional credit cards, and has at least 50% BNPL wallet share across the major Indonesian e-commerce merchants (Tokopedia, Bukalapak, Lazado, etc).

Indonesia’s broken financial system has driven consumers to credit alternatives such as Kredivo. Structural bottlenecks related to poor credit bureau coverage alongside banks’ risk aversion has led to penetration of only 0.15 credit cards per eligible Indonesian. Kredivo is therefore not competing with Indonesian credit card companies, it is the credit card company.

And the offering appears to be compelling, with users demonstrating 2X basket size, 3X transaction rates, and more than half of Kredivo merchants say the platform increases conversion. Kredivo’s platform is particularly compelling amongst Gen Z consumers, who appear less interested in credit cards as their elders, preferring responsible and transparent payback platforms such as the BNPL model.

Kredivo’s growth plans involve expansion to Vietnam (Q3 2021), Thailand (Q1 2022) and the Philippines (Q2 2022), as well as personal loans, neobanking, and credit cards (you know, the fintech master plan). Kredivo is following in the footsteps of Square (SQ), SoFi (SOFI), and local peer Sea Limited (SE) by building up a stake in a local bank, Bank Bisnis of Indonesia, to accelerate its neo-banking initiatives. Kredivo intends a fresh rebranding, launching ‘Lime Bank’ in Autumn of this year.

Reading Kredivo’s investor presentation felt very timely, given Square’s recent acquisition of Australian-based BNPL firm Afterpay for a whopping $29 Billion. This purchase validated the entire BNPL space – look no further than Affirm (AFRM), which is up over 20% since the M&A announcement.

Below I have provided my comparison of Kredivo vs Afterpay to get an idea of Kredivo’s merger valuation. While Afterpay continues to flex industry-leading growth rates, Kredivo is nipping tightly at its heels. Based on my assessment, Afterpay enjoys a 3X+ multiple higher P/S ratio than Kredivo, despite growth similarities. It seems like investors (ahem, Palantir) are getting quite a deal…I would be a buyer at the merger price.

Kredivo vs. Afterpay

Source: me

To make the investment even more appetizing, Kredivo’s unit economics are absurd. Kredivo pointed to 9$ CAC’s driven by organic and often merchant-led discovery, with LTV’s of $119, resulting in an astronomical LTV/CAC of 11X and a payback period of 3.5 months. This is the second lowest CAC I have seen in the fintech space, behind only Square and Gandalf the Marketer, Jack Dorsey. Microscopic CAC’s are the fintech holy grail.

Source: Kredivo Investor Presentation

A few months ago I wrote the following about Square:

“In the banking space, the company that optimizes lifetime value [LTV] vs customer acquisition cost [CAC] is the company that wins.

Read that again, write it down, bold it and underline it.

This is not supernatural. Behind the B-school terminology is a basic principle of unit economics: make more from a customer than it costs to acquire them, and do it better than competitors.”

Source: Square: Winner Takes Most

Kredivo’s unit economics are exceptional. And Kredivo is already well on its way down the well-worn fintech path to super app status with banking and an array of loan options in the pipeline. These products will drive that LTV/CAC multiple even higher, fueling top and bottom line growth.

The result? Kredivo could become the Square or SoFi of Southeast Asia. That is the opportunity at stake.

There are numerous ways Kredivo can benefit from a Palantir partnership. Remember, Palantir was inspired by fraud detection technology built on the PayPal platform. Max Levchin, co-Founder alongside Peter Thiel of PayPal, similarly used PayPal-inspired tech to build BNPL platform Affirm. This is not a coincidence.

Palantir already has its tendrils deep within the financial services space, and can assist with credit underwriting analytics, fraud detection, etc. These same insights can be used to benefit Foundry for Builders’ (likely) BNPL customer, Tillit.

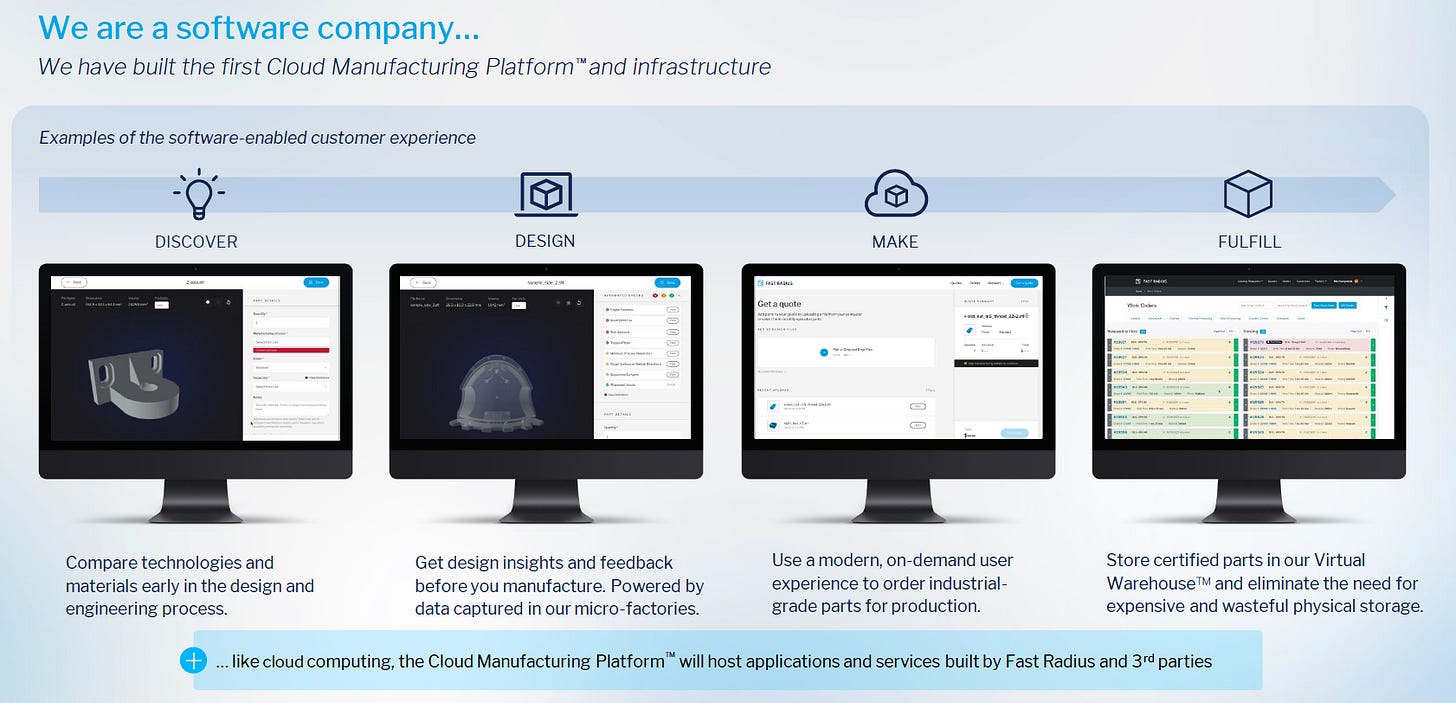

Fast Radius: Future Industry 4.0 Stalwart

Fast Radius is the last of the dozen SPACs. It is a pure play in digital supply chain, manufacturing, and the fourth industrial revolution. For those of you who haven’t heard of Industry 4.0, it refers to unprecedented innovation across the tools of AI, cyber-physical systems, internet of things, industrial grade additive manufacturing and the smart factory.

Fast Radius does each of these things, and is far and away the investment I came away most bullish about for this article.

Fast Radius intends to merge with ECP Environmental Growth Opportunities Corp (ENNV) later this year, and the PIPE was led by investments from Goldman Sachs, United Parcel Services (UPS), and Palantir. The merger will value the company at $995 million in pro forma enterprise value.

The company engineers physical products for customers using additive manufacturing, or “3D Printing” software. Customers include 10% of Fortune 500 companies, including Aptiv, Toyota, UPS, Collins Aerospace, Airbus subsidiary Satair and Ford Motor.

Fast Radius has the tagline “The biggest revolution in manufacturing since the assembly line.” Pretty bold, right? But in my opinion, fitting.

I don’t want to get too lost in my excitement over the Fast Radius investment opportunity, but let’s spend some time on their ‘micro-factories.’ Fast Radius refers to these highly scalable units as “factories in a box that can be copied and pasted,” given the velocity with which they are erected and operating.

In 2018 the World Economic Forum recognized Fast Radius with the enviable “Lighthouse” designation, and marked its Chicago factory as one of the nine most advanced factories in the world (the only one in the USA). Then in 2019, Fast Radius received one of fourteen “End-to-End connected value chain lighthouse,” awards for a factory network plus software platform.

Keith Rabois, co-founder of Opendoor, general partner at Peter Thiel’s Founders Fund, and OG member of the PayPal mafia tweeted the following:

Manufacturing is perhaps one of the most fragmented industries in the world, fracturing further under the weight of carbon emissions concerns, slow-moving supply chains and centralized mega-factories. Fast Radius is reforging a broken industry, raising from the crucible a cleaner, lightweight, vertically integrated industry of the future. And customers are delighted – Fast Radius boasts an NPS of 71.

Source: Fast Radius Investor Presentation

Although Fast Radius projects only $25 million in 2021 revenue, elevated growth is expected to persist through 2030 at a CAGR of 65% (2030E revenue $2.1 Billion). Furthermore, Fast Radius has exceptional unit economics, with best-in-breed manufacturing SaaS LTV/CAC ratios of 5x – 8x and a payback period of around 6 months.

Perhaps what I am most excited about is the audacity of Fast Radius’ growth ambitions. Founder and CEO Lou Rassey aims to build the first $100 Billion cloud manufacturing and digital supply-chain company. Wow Lou, that’s a 100X return from here. And marbled throughout the investor presentation are references to future product launches, such as the ‘AI Assistant.’

This includes conversational AI, with whom engineers can ask questions like “What’s the best way to make this? How long will it take? Run diagnostics on my Iron Man suit,” (probably, etc).

If Sarcos is building the Iron Legion, Fast Radius is building Tony Stark’s J.A.R.V.I.S.

Source: Jennifer and I

There is a romantic catharsis in the sentiment that Palantir, the business driving the revolution of data is an investor and early partner in the company driving the revolution of industry. Keep an eye on this one, I will be a buyer.

Palantir’s SPACs: Initial Thoughts

When I first began reading about these new investments I sat back in my chair, a bit underwhelmed. Of course I was. The original six Palantir SPAC’s were the stuff of sci fi; Orwellian ghosts bolted to titanium exoskeletons with finely machined brains. Boxed, Tritium, Pear, Kredivo and AdTheorent are compelling investments, yes, but quite plain by comparison. Only Fast Radius handily secured that futuristic designation.

Part of this is my own laziness. As a writer, of course it’s easier to present an engaging host of fantastical, new-age businesses. But while I sat there reverse-engineering Palantir’s strategy, I gained a crucial insight. Palantir is demonstrating Foundry can be used to augment, improve and scale businesses of all shapes.

Harvesting dinosaur DNA from amber-trapped mosquitos for an amusement park? Palantir can help you simulate cage security features well before opening day.

Refining a chemical that allows paint to dry more evenly? Palantir can perform binding assessments in silico.

Foundry is not just for futuristic tech companies. Palantir brings the sci fi to each and every business it partners with.

Palantir Is Expanding Downmarket

Palantir began by doing something very few businesses can — serving the absolute highest end of enterprise with white glove bespoke software — the US government, the bluest of blue chip Fortune 100 companies. But now Palantir is flexing something even more impressive — ubiquity. Palantir has turned its advanced sights on businesses of all sizes — from billion dollar SPACs to scrappy startups. And each are expansions downmarket.

Palantir is gaining so much more than revenue or client volume here. It’s getting closer than any company I can think of to its own innovative DNA by standing shoulder-to-shoulder with the startup. Palantir is leveraging its own technology to identify and buy call options on the mega caps of the coming decade.

To cleanly summarize, Palantir benefits from its small business and SPAC investments in the following five ways:

1.) Equity ownership in future tech titans. Palantir’s technology (Process Power moat) and relationships increase the probability early stage companies will achieve scale and succeed, ensuring Palantir spent these monies profitably.

2.) Palantir is establishing high-revenue services agreements with these companies. This means Palantir broadens customer volume and assures ROI (a full doubling in most cases).

3.) Palantir gains insights into a variety of innovative business sectors, which can be brought upmarket to more complex, higher-paying customers, and returned again. This is a flywheel. Palantir’s SPAC portfolio now benefits from Palantir’s commercial and government relationships, which foment partnership and contract opportunities.

4.) Palantir can make introductions between investment companies, catalyzing game changing relationships, which allows Palantir to double dip in gain amplitude. Partnerships that make sense off the top of my head:

Fast Radius can spin up supply chain and manufacturing for Lilium, Sarcos and Tritium.

AdTheorent can drive high performance advertising campaigns for Palantir’s entire life sciences division (Pear, Roivant, Cellularity, Babylon), as well as Boxed, Lilium, Sarcos, Tritium, and Kredivo.

Wejo can provide geospatial imaging, tracking and IoT connectivity for Lilium’s fleet of eVTOL jets.

5.) Palantir dramatically expands its TAM by making Foundry a compelling offering for businesses of all scale. Palantir recently reported its TAM at $119 Billion. When small businesses are included, that initial number will look tiny. Foundry for Builders sales will help drive hypergrowth well above the benchmark 30% over the coming decade.

In light of these learnings, Palantir failing to invest in SPACs and start-ups seems borderline fiscally irresponsible.

SPACs and Startup’s: Take-Home Points

The structure of Palantir’s recent behavior is beginning to take shape. These investment companies were not selected simply for the alpha they may generate.

I’m not reading tea leaves here. As a student of Palantir’s history, I see a deliberate, thoughtful strategy. Each of these investment companies are boldly setting out to revolutionize their sector with data, uniquely poised to benefit from a Palantir partnership, and are complementary to Palantir’s growth initiatives, business sector playbooks, and principles.

Palantir’s investment behavior represents a preparatory, but decisive step towards launching Foundry for businesses of all sizes.

Look no further than the commerce signature stamped throughout this round of investments. Boxed is a full-stack e-commerce platform, Kredivo and Tillit help drive e-commerce GMV, neo-banking, and in-person conversion, Fast Radius is reinventing industry and manufacturing, and AdTheorent offers data-driven marketing. Palantir’s partnerships with these businesses will allow Foundry to capture insights into the full-spectrum of commerce, which can be applied to nearly any small business.

And I expect this.

The Perils Of Seeing Too Much

If there is a learning most vital to be found in the wonder of J.R.R. Tolkien’s universe, it is that there is a peril in power, its use and pursuit — in seeing too much. I believe Palantir will become as large and as influential as the mega-cap titans it has verbally and physically distanced itself from. At baseline this worries me, but it is also the keystone on which I rest my entire investment thesis.

To invest in Palantir is to believe Karp and Thiel truly have the best interests of the USA and the free world top of mind. That Karp is our Bruce Wayne, rendered in the sharp lines of reality, willing to make the tough decisions others can’t. This is a big ask, and something I carefully monitor, even if it doesn’t always show up in my articles. Palantir is the hero we both need and deserve.

And at the present moment, I do not believe this faith is misplaced. Palantir’s track record of coming through in no-fail scenarios, offering services in the most dire circumstances (war on terror, COVID-19, Foundry Unlock) rather than outmaneuvering a crisis to extract value from others, is a template for mega caps to emulate. I see Foundry for Builders as more invigorating to our economy than any stimulus check; it is a necessary accelerant in the COVID-dented fuselage of American small business.

Consistent with these ideals, I would be remiss if I did not highlight the goodwill Palantir has garnered with its recent round of SPAC investments. Almost across the board, these investment companies demonstrate commitment to ESG principles (Environmental, Social, Governance) – building a kinder, more conscientious tomorrow. Palantir is therefore sharing its strength with, and elevating, these neighborly businesses and leaders. I have highlighted some (but inevitably not all) of these expressions of goodwill.

Boxed: In 2016, Boxed launched the Rethink Pink campaign to end the upcharge on women's hygiene products, AKA the Pink Tax. Boxed reduced the per unit price to match the male equivalent for all items in this category. Seven Oaks Investment includes a Chief ESG officer, Randolph Tucker, on their executive board (the only such position I have seen), demonstrating unique alignment with these principles. Additionally, Boxed’s CEO Chieh Huang pays college tuition for all Boxed employee children.

Tritium: As an infrastructure leader in the EV revolution, Tritium is accelerating the movement away from ICE and associated carbon emissions. Consistent with this mission, Tritium chargers have already offset 1.6 million gallons of gasoline.

Pear Therapeutics: With reSET and reSET-O, Pear is uniquely positioned to address several addictive illnesses invented by the traditional pharmaceutical industry, sans adverse effects. Furthermore, Pear has secured emergency use FDA authorization to offer its Schizophrenia product to help individuals undertreated in the COVID-19 mental health infrastructure collapse.

AdTheorent: AdTheorent is a data responsible advertising firm with privacy-forward solutions, and does not harvest personally identifiable data points.

Fast Radius: Fast Radius is backed by Environmental Growth Opportunities, an investment vehicle with a consistent track record of identifying sustainability-linked businesses. Fast Radius’ business model is predicated on decreasing transportation emissions, energy consumption, and material waste. In addition, Fast Radius demonstrated agility in response to the COVID-19 pandemic, meeting urgent need in medical device demand (ventilators) in a matter of weeks in the first wave of COVID-19.

Palantir: Closing Thoughts

Remember well that machine learning and artificial intelligence are informed by data. Good data. The more ingested, the more sophisticated the data analytics product gets, the less coincidence is confused with pattern. Palantir’s new investments and behaviors are data – which I have internalized – and I am beginning to see the pattern.

Palantir is arming the Builders. From world powers to bootstrapped startups, Foundry is the gleaming forge around which an accelerating flywheel orbits. This is a virtuous cycle that benefits Palantir, yes, but also re-conceives our understanding of tomorrow’s business and its capabilities.

The potential of data to transform business means Palantir stands at the center of whatever room it is in, the cynosure of all eyes. And with Foundry for Builders, this attention will become even more intense. Early data are promising, and point to principled leadership building a likeminded tomorrow.

I expect Palantir, led by Karp and Thiel, to continue to patiently execute on the long term strategy to become the most important company in the world. I also expect Palantir to share this strength with other equitable leaders, so that powerful data may become similarly responsible.

Special thanks to Jennifer Hess for her wonderful artistic abilities, and for supporting me spending so much of my free time on this article. Thanks to the Palantir community for continuing to read.

Thoroughly enjoyed the write up here, you've got a way with words and telling the tale of Palantir. You might want to consider putting together your own Tolkien-esque, epic saga some day. As an experienced Palantir user from within the military, I can tell you the design to this software was so intuitive, so user-friendly that even the least tech-savvy among us could use it easily after a quick class of instruction. Those who were more tech-savvy were able to make this software sing, producing detailed products of immediate benefit both at the tactical and strategic levels. Even some of our most hardcore opponents of the company were won over, in the end. If Palantir has maintained this ease-of-use, intuitive feature, then I truly believe the sky is the limit.

Fantastic article on the proposed Tax bill, ty.

Perhaps you are awhere PLTR has invested more SPAC's, BlackSky (sftw) in particular. Volume is up big time, secured a 30 million contact. Seems exciting.

If you think it's worth to investigate & write about...?