Opendoor: The Art of Winning an Unfair Game

Thinking Like Amazon, Path to Profitability, and the Power of Spectacular Product

Welcome to the 225 new and curious minds who have joined The Operator since January 3! If you are reading this but have not subscribed, join 1,270 skeptical and relentless others by subscribing here:

“How can you not be romantic about baseball?”

Billy Beane, Moneyball

The 2002 Oakland Athletics were a baseball team in crisis.

Following playoff elimination in 2001, the Athletics lost MVP Jason Giambi and All-Stars Johnny Damon and Jason Isringhausen to free agency — with no capital to replace lost star power. Armed with a budget of $44 million, how would the A’s compete against the $125 million of the Yankees?

Cornered, Athletics’ general manager Billy Beane implemented an unconventional but courageous strategy — one that flew in the face of more than a century of baseball wisdom.

You see, baseball teams rely on scouts to evaluate player talent. Scouts are often former players or coaches, and have deep experience valuing players. But instead of deferring to the expertise of scouts, Beane began using what is known as “Sabermetrics,” or baseball data science, to identify players misvalued by traditional metrics. Through statistics, Beane reasoned, the A’s might be able to compete with the deep pockets of even the Yankees.

What followed in the 2002 season was just short of magic.

Despite having the third-lowest payroll in the league, the A’s finished first in the American League West, winning an almost incomprehensible twenty games in a row — the longest win streak in Major League Baseball in 67 years.

Understandably, news the Athletics were using high-brow mathematics to gain an edge in something as physical and storied as baseball ignited emotions around the country.

After all, what’s more American than baseball?

In fact, I would argue the only thing more American than baseball is owning a home. A front porch and a white picket fence. A yard to fret over, and a place to raise a family. And yet not one year after data science was being used to transform baseball, Peter Thiel galvanized Keith Rabois to reinvent residential real estate.

“Back in 2003, Peter Thiel said “Come up with an idea that’s going to innovate in residential real estate. It’s the largest part of the US economy that’s been unaffected by technology.”

Keith Rabois, Opendoor Co-Founder

Inspired by the task, Rabois formulated a characteristic contrarian thesis — that data science could be used to model home prices, sight unseen — that mathematics could automate a realtor’s valuation expertise.

He even thought up a name for the venture, calling it “Homerun.”

Rabois spent the better part of the next decade recruiting the right roster to make concept a reality, ultimately assembling JD Ross, Ian Wong, Ryan Johnson and Eric Wu to found the company in 2014. Although “Homerun” was rebranded as the similarly romantic, “Opendoor,” this allegory offers a critical insight.

Owning a home is emotional. It’s personal, and it’s core to the American Dream.

As a technology company using data to buy and sell homes, Opendoor has inherited a certain emotional fog. Most people I talk to write off the company on the elevator pitch alone. I’ve called Opendoor misunderstood, discounted, and undervalued — and it’s been each of these things throughout its early life as a publicly traded company. But beneath that cynical nebula is a company executing, against all odds, in the service of the consumer — a consumer who has historically enjoyed no leverage, transparency, or security in the largest transaction of their lives.

So today, we revisit and review the case for investing in Opendoor. We’ll discuss Opendoor’s path to empower the disenchanted American homebuyer, its purpose-built Amazonian culture, a roadmap to profitability, and look out to the whitespace opportunity ahead.

Spoiler alert — I suspect we are in the first inning of Opendoor’s story.

Opendoor’s Fourth Quarter and Full Year 2021 Results

As of yesterday, Opendoor’s first full year of earnings are in the books. Opendoor graduated 2021 magna cum laude, outperforming even my most quixotic estimates.

In Q4, Opendoor sold even more homes than it acquired, and ended the quarter with $6.1 Billion in inventory. Net loss was higher than expected ($191 million), due to 180 bps sequential decline in gross profit, higher selling costs, and higher stock based compensation. That said, both gross profit and contribution margins are well within management’s guideposts.

Opendoor’s 2021 results materially outperformed guidance on both the top and bottom lines. Revenue beat guidance by more than 100%, meanwhile contribution profits were 3X higher than expected.

Guidance for 2022 implies persistent rocket-ship velocity in revenue growth — greater than $8 Billion revenue in the first six months of 2022, and $4.1 - 4.3 Billion in Q1 alone.

Opendoor doubled market footprint in 2021 to 44 markets, and now has a presence in 17 of the top 20 most populous cities in the United States. The company signaled its intention to add dozens of new markets to the map this year, including San Francisco (launched this month). Links on the Opendoor Careers page indicate launches in Canada, New Jersey and even New York, are on deck.

Opendoor also acquired three companies in 2021, each of which will play a unique role in the company’s ancillary aspirations in the years to come:

Skylight: San Francisco-based digital home renovation company delivering full service remodels and renovations for kitchens, bathrooms and other interior spaces.

Pro.com: Seattle-based general contractor streamlining the home renovation process with automated bids, mobile-friendly quote tools and project management services.

RedDoor: Sacramento-based digital-first mortgage brokerage that can approve a loan applicant within 60 seconds. (Coincidentally, Red Door Coffee in SF is where cofounders Keith Rabois and JD Ross met).

In 2021, Opendoor launched two incredible products — both of which provided much-needed ammunition to 2021’s home buyers, who struggled to compete in a seller’s market:

Opendoor Backed Offers (OBO): All-cash offer made by Opendoor on behalf of customers for a given home, comparable to the products of the “Power Buyers,” such as Homeward, Flyhomes, Reali, Orchard, Knock, and Ribbon.

Opendoor Complete: The entire process of selling, buying and closing combined in one simple transaction — similar to coordinating a round trip flight. Complete includes a dashboard for managing the process to ensure consumers can move on their schedule, avoiding double moves and double mortgages.

2021 iBuying Report Card and Q1 ‘22 Sleuthing

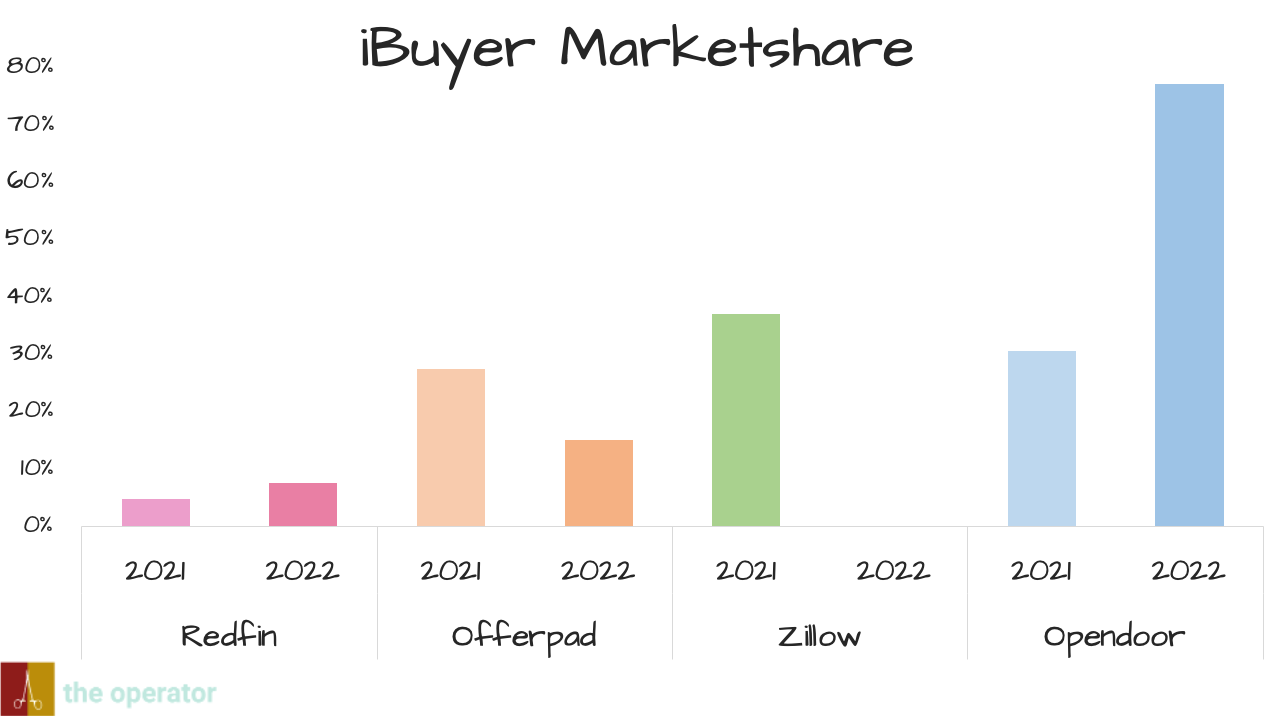

Today, Opendoor ventures into a markedly changed iBuying landscape compared to a year ago. With Zillow out of the picture, Opendoor has claimed 77% of the iBuying space by revenue, 4X larger than the next closest competitor, Offerpad, and 9X larger than Redfin.

As each of Redfin, Zillow, Offerpad and Opendoor’s full-year earnings are in the books, it’s important to look back on how far we’ve come. If this were the Academy Awards, we’d be handing out the following Oscars:

Best Growth:

Despite growing from the largest base, Opendoor managed a blistering pace in 2021. Only Zillow attempted to keep up, and it proved fatal. Superior technology, operational execution and a snappy logo go a long way.

Best Profitability:

Offerpad takes the cake for best profitability in 2021, eking out 5% more contribution dollars per home sold than Opendoor. While I don’t love it, this makes sense to me. Offerpad is moving much more slowly, selecting homes with lower risk profiles and performing more renovations than Opendoor (slightly closer to the home flipper designation). Furthermore, Offerpad is investing significantly less in its technology, and continues to rely more on the human component of home valuation rather than automation. While this makes for nice quarters today, it’s worth asking the question how well this will scale in the future.

Best Marketshare Gain:

A combination of meridian velocity and Zillow’s bitter exit allowed Opendoor to more than double iBuying marketshare in 2021. Conversely, Offerpad’s slow-and-steady strategy resulted in a material marketshare decline. The good news for all surviving parties is that the overall iBuying market grew 10X year over year.

Looking ahead to Q1 2022, there are two clear takeaways from Opendoor’s early performance: transaction acceleration and profitability.

Transaction Acceleration

In Q4 2021, Opendoor managed to sell more homes each consecutive month. While I’m not going to provide absolute home transaction numbers for Q1, I will confirm that trend continued through February. Most impressively, Opendoor is on track to sell significantly more homes in February than it did in January.

This past week, a record 1,332 Opendoor homes went from ‘For Sale’ to ‘Pending.’ This is a 3X higher rate of sale than we saw in November 2021.

While I am still waiting on pending and expected sales to close before I can release estimates for the coming quarter, Q1 ‘22 revenue guidance already seems again, low.

Profitability

Pricing execution, combined with favorable HPA dynamics has made space for Opendoor to possibly achieve something we were told not to expect until 2024 — profitability.

Opendoor is accelerating transaction volume in Q1 at the highest margins we’ve seen since early 2021. Through the first six weeks of 2022, Opendoor lost money on only 93 home sales, or 1.74% of observed transactions. Gross profit per home sold has improved each month since October, and Opendoor is seeing double-digit gross profit margins in six states.

Furthermore, Opendoor’s buy-to-sale premium curve (a more definitive version of the ‘buy-to-list premium’ chart) improved in February, shifting convincingly to the right.

Note, the above chart does not include Opendoor’s 5% fee.

After reviewing Opendoor’s early Q1 performance, I believe it’s fair to say Opendoor’s Q1 results will be closer to profitability than any preceding quarter — despite record scale. I expect contribution profit to double quarter over quarter, and > $100 million in adjusted EBITDA.

2021 Market Reflections

2021 will go down as one of the hottest real estate markets of all time. A confluence of record low inventory, depressed mortgage and interest rates, and work from home created a seller’s market the likes of which we may never see again.

That Opendoor was able to shatter expectations in 2021 shocks me, because its core product “Sell to Opendoor,” was designed to make selling a home easier — the kind of product I imagine wouldn’t exist if the past year’s market conditions were the norm. It’s like selling umbrellas in a drought — the value proposition just doesn’t make sense. Opendoor offers speed, certainty and simplicity, product traits that bear a much greater premium in a slowing or down market.

And yet, Opendoor managed to post tremendous growth metrics, with revenue double guidance and profitability in the wings. Conversion north of 35%, Net Promoter Score > 80, nine out of ten customers recommend to a friend. This is the type of scalding product market fit you have to add water to; that you keep in pressurized containers with block letter warnings that say KEEP AWAY FROM EYES AND MOUTH. I know founders who would give their good hand for a diluted version of what Opendoor has on tap.

This is the most impressive characteristic of Opendoor’s 2021 performance. While Opendoor is/will be a market maker and share gainer in all cycles, it was built for exactly the opposite conditions we saw in 2021, and still crushed it.

A Purpose-Built Culture

“If you’re going to do anything new or innovative, you have to be willing to be misunderstood. And if you can’t tolerate that, for god’s sake, don’t do anything new or innovative.”

Jeff Bezos, Founder, Former CEO, Amazon

Opendoor is often likened to an early-stage Amazon. Both companies carry a chimeric helix of atoms and bits, charting a bold course into a vast legacy market. Both companies built incredible, low margin consumer products as a wedge into more profitable verticals. But I believe the most defining similarity is a common culture, and many of Opendoor’s advantages derive from its Amazonian ethos.

“I really like the saying, ‘If you’re not comfortable with being misunderstood for long periods of time, you probably shouldn’t do anything new or interesting…’

One of the things we talk about internally is to have a hulk mentality. What that means to us is that it’s important to build strength through adversity. And so as things get more difficult, and things will always be very hard whatever you do, you should find strength.

So when it comes to investors saying yes or no, I think there are times we have to say, I firmly believe in what we are building, and be misunderstood for long periods of time.”

Eric Wu, CEO Opendoor

iBuying is a risky, capital intensive, low margin, bloodsport of a business. Hard stop. It’s a treacherous model that has already torpedoed the most iconic RE tech company on the planet. And yet, look closer, there’s something compelling there. That Opendoor has survived despite the astringent iBuying conditions speaks to a core competitive advantage.

When it came to hiring, Wu realized Opendoor could not compete with the incredible perks and salaries of Google and Meta, so he chose not to compete at all. Instead, Wu focused on identifying undiscovered or misvalued talents — individuals passionate about the mission of revolutionizing moving.

“We made the decision this past year…to build a culture of frugality. We brought in Amazon executives and board members, because we believe strategically that the lowest-cost structure will win…

We had a salary cap at Opendoor. No employee made more than $120,000 for two years…Do you know how hard it is to create a culture of frugality — in Silicon Valley? It’s very difficult…

You have to make trade-offs. People opt-in to the culture, or not, and that’s OK. We’re going to hire the people who want to be scrappy and build something that matters...”

Eric Wu, Proptech CEO Summit, November 2019

A focus on hiring missionaries rather than mercenaries is a formidable advantage. If you speak to Opendoor employees the distinction is clear — they believe they are building something truly special. And this philosophy engenders unique talent density — confirmed by the number of early Opendoor employees who are now founders.

A culture of frugality manifests as a structural advantage over peers — and necessary to compete in the iBuying space. Perhaps best illustrated in Q3 of 2021, when Zillow — three years, billions of dollars, and a new CEO into its “Zillow 2.0 transformation” — collapsed under the Mariana-Trench-like pressures of the iBuying space like a dying star.

In retrospect, of course Zillow failed at iBuying. Zillow is a high margin search company with plenty of perks and margin points to throw around. But iBuying is not just technology, not just moving bits around the internet — it’s also hard assets. Bricks and clicks — the composite. Zillow only ever had one strand of the DNA required to make a successful business, and in iBuying, there are no half measures.

A company built to thrive in unfavorable circumstances will always win out against competitors, even larger, better funded ones.

This is my favorite of Opendoor’s moats — this Amazon-derived culture of frugality and the missionaries it’s attracted. There will be always be competition, and there will always be naysayers, but Opendoor was deliberately built from Day 0 to outlast them.

The Characteristics of a Monopoly

In February 2019, Rich Barton returned to the company he co-founded, Zillow, to serve as CEO. Under his visionary leadership, the company would transform into “Zillow 2.0,” and enter the increasingly competitive iBuying space.

But why did Zillow, a wildly successful RE search and advertising company, choose to venture into the harsh extremes of buying and selling homes at scale?

I believe the prevailing impulse was fear.

The following is an excerpt from an interview Barton had with The Information in 2019:

But Barton says Zillow didn’t have a choice. Opendoor’s offering, called instant-buying, had become a phenomenon. It was “an existential threat because if it works and we don’t do it, we get displaced as the marketplace, theoretically,” Barton said.

What Barton feared in 2019 is rapidly approaching, as the write-offs, layoffs, and inconsistent excuses for the failures of 2021 threaten to consume this once iconic company from the inside, like an autoimmune disease.

Zillow recently announced respectable Q4 numbers, managing to offload housing inventory faster than expected. Making a sophisticated managerial pirouette, Barton trumpeted Zillow would more than double revenue in its core businesses by 2025, and that he would build the “Housing Super-App.”

Forgive me if I seem skeptical.

In my last article, I delved deeply into the super-app model. The core concept is by owning the entire transaction stack, end-to-end, you can optimize both customer experience and value, as ancillary product CAC is absorbed as profits. Financially, it’s a dream. A walled garden consumers never leave. But by giving up on iBuying, Zillow forfeited end-to-end control of the transaction — and therefore has no leverage to build a super app.

Zillow 3.0 is Zillow 1.0 behind a fresh coat of paint and a chic soundbite — a reversion to the mean. A tax on a system that hasn't changed in decades. And with Zillow’s dominance eroding, I’m not sure its 2025 revenue goals are reasonable either.

The iBuyers are coming for Zillow’s platform, with Opendoor leading the charge.

As of Q4 2021, only 0.32% of all American home transactions were performed through Opendoor. Not exactly critical mass, but rapid growth and market expansion indicate Opendoor will enjoy a significant minority of transactions in the near future. After all, Opendoor already boasts low double digit share in its oldest markets. And with Zillow out of the picture, Opendoor enters 2022 with nearly 80% iBuyer marketshare, growing multiples faster than the next closest competitor. As more homes are listed on its platform, and Opendoor aggregates supply and demand, network effects take over.

Why browse homes on Zillow’s platform if an accurate home price and “buy it now” is available on Opendoor?

The endgame of aggregating supply and demand is marketplace optionality. Increasingly, Zillow, and Redfin will lose advertising pricing power as Opendoor steals eyeballs and builds a marketplace. Through this marketplace, Opendoor can monetize third-party/off-balance sheet transactions, which are high margin and capital light.

In Zero to One, Peter Thiel points out that competition has been incorrectly mythologized. He writes that in a state of perfect competition, no company makes an economic profit, and that the opposite of such competition is a monopoly:

“All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.”

Make no mistake, competition is for losers. Opendoor escaped competition by building something new that was impossible for others to emulate. And just as Amazon enjoyed a decade of competition-free growth at the turn of the millennia, so too will Opendoor — a monopoly in the making.

Zillow can keep their ‘housing super app’. Opendoor is building the killer app.

The Power of Spectacular Product

It’s challenging to overestimate the power of a spectacular product.

Using an incredible consumer experience as a wedge into more profitable verticals is a distinctly Amazonian strategy. Amazon Prime is perhaps the greatest consumer service in the history of business, yet demonstrates middling profitability. In Amazon’s 2015 shareholder letter, Jeff Bezos wrote:

“We want Prime to be such a good value, you’d be irresponsible not to be a member.”

Prime is not meant to be profitable — it’s meant to be adored.

I love the idea of a company designing a product so valuable it would be fiscally (and otherwise) irresponsible not to use it. By ruthlessly chipping away at costs and passing savings back to consumers, Prime has cleared the way for Amazon’s distinctly more profitable marketplace and AWS offerings.

Sell to Opendoor carries these same characteristics, but arguably offers even greater consumer value. The product involves none of the years-of-life-lost of offline real estate, and its commissions are lower than what realtors charge.

This is simple, but if you can build a better user experience, and offer it more cheaply, you win the category.

In 2019, Opendoor had real seller conversion of 25% with > 10% commission fees, yet chose to cut those fees in half to create world class consumer value. And I don’t think they’re done. As Opendoor scales supply and disintermediates offline transactions, I expect commissions to fall further.

iBuying was never Opendoor’s final act, nor is it going to be Opendoor’s profitability center. It’s a consumer experience so spectacular you’d be irresponsible not to use it.

Opendoor’s Path To Profits

Opendoor invented and dominates the iBuyer category, yes, but is it a business worth winning? Where’s the profits? Where’s the margin?

Let’s begin by revisiting the typical commerce cycle for the American homebuyer, which is roughly 7 years.

In my opinion, people tend to think too rigidly about Opendoor as “just an iBuyer.” They see the earnings, read the headline gross margins and chuckle, saying “Yeah, not for me.”

I firmly believe that to be a good technology investor, it’s important to think in slope, rather than intercept. To suspend the characteristics of today and reimagine the shape of tomorrow’s business. To play the game of Prometheus. And Opendoor’s opportunity to vertically integrate the fragmented, single-product, low NPS, offline RE services industry, is massive.

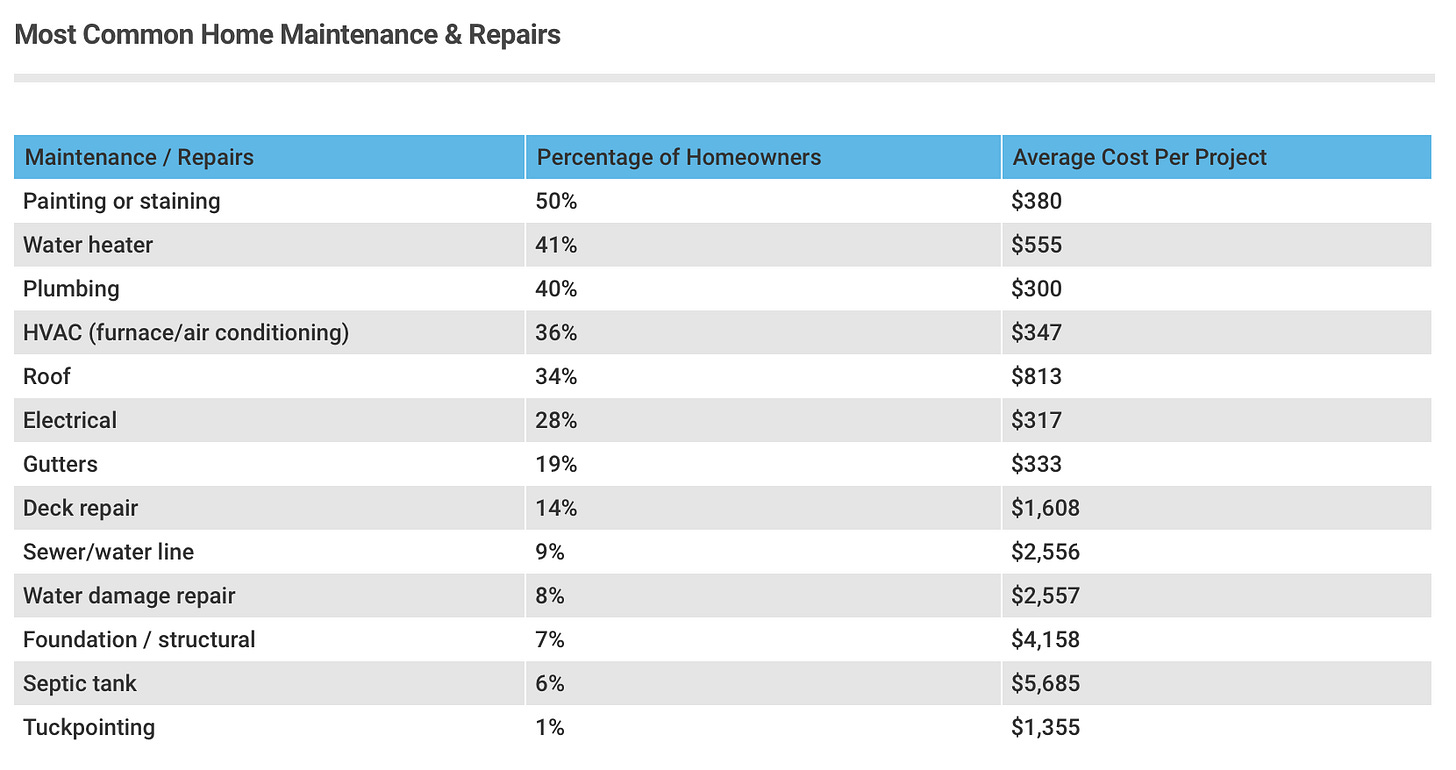

There are dozens of home transaction and home maintenance-adjacent products, each of which has a target on its back for a scaled operator with the right DNA.

For example, according to Clever Real Estate Survey & Home Advisor, each year the average American homeowner spends $2,676 on maintenance and repairs, $6,649 on home improvement, and $1,228 on homeowners insurance, for a total of $10,553. That’s 2 - 3% of the mean American home value, spent each year. Furthermore, 59% of those homeowners are making renovations with some combination of credit cards, personal loans, and home equity loans.

Real estate and home maintenance technology remain persistently in the past, stubbornly undisrupted. Technology companies have made some incredible 10X improvements over the years, but began with the easiest problems, the lowest hanging fruit. Building the infrastructure to optimize moving or home maintenance is a uniquely challenging problem — but also a problem uniquely suited to Opendoor.

In the spirit of solving hard problems, for the first time, I would like to introduce what I would build if I were on the Opendoor team. What follows is the long-tail opportunity, the profit optionality — let’s call it Opendoor Home.

Introducing: Opendoor Home

Opendoor Home is the entire bullpen of embedded finance services squirreled away in the home transaction and ownership stacks. I divided these ancillary verticals into Transaction Services and Home Services.

Transaction Services

Residential real estate is a byzantine racket, chock full of inexplicably expensive services offered by legacy cartels. For example, did you know there are seven components to a mortgage payment? And I have no idea what ‘tuckpointing’ is.

Each and every mortgage broker, TV installer, mover, or insurance agent is working for their own, single-product company, which spends a material portion of earnings on customer acquisition (CAC). In this regard, Opendoor stands alone.

Opendoor only spends CAC persuading a consumer to buy and/or sell a home. And once that consumer enters their ecosystem, these ancillary services cost nothing in further acquisition — which means they can be offered more cheaply and at higher margin than competitors. Hopefully it’s not lost on you that this model means superior consumer value as well. This is using scale as a surgical instrument.

By owning the transaction, Opendoor is able to use bundling as a superpower against fragmented incumbents.

I consider the following Transaction Services, verticals Opendoor will increasingly monetize over the coming years:

By way of anecdote, in July of this year I’ll purchase my first home in Tennessee, near Vanderbilt, where I’ll complete my final year of surgical training in Facial Plastics and Reconstructive Surgery. I like to imagine we (Jen and I) will use Opendoor’s platform to purchase the home of our dreams, in a hassle-free, one-click process. That’s Opendoor 1.0.

But Opendoor 2.0 grants consumers exposure to the indelible consumer value that results from owning the entire stack. It means we can select a date for Opendoor movers to pack up and deliver our furniture, and get both “Mow my lawn before move-in,” and “Set up my TV and Internet” for free, because I chose to mortgage my home through Opendoor. No being directed to third parties, no weeks lost identifying dozens of vendors to choreograph a traditional move — the whole process is e-commerce, self-service, on demand.

Take a moment to bask in this alpine interpretation of moving.

Solving for ‘moving’ (the service of packing belongings and transportation to a new destination) is the key to unlock the transaction services stack. Unfortunately, moving is also the most challenging product to do right — at baseline moving is a fragmented, low NPS, capital-intensive, atoms-first industry that has never been vertically integrated (sound familiar?). But, if Opendoor can build the fulfillment infrastructure needed to offer moving as a bundled product for customers, and optimize to a white-glove experience — wow. You’ve got magic.

Ancillary attach rates will skyrocket as consumers reconcile multiple world class products. And with the miserable cost and friction of moving dispelled, the activation energy of moving plummets to a level we haven’t seen since nomadic times. Suddenly, residential real estate becomes liquid — accelerating Opendoor’s flywheel as more and more families are empowered to move.

But the consumer relationship should not, and will not, end at the transaction. Long after a family has unpacked their last moving box, Opendoor will continue to provide value. This brings us to Home Services.

Home Services

Eric Wu has previously referred to Home Services as “Live with Opendoor,” and he’s kept these cards close to his chest. Consequently, I’ve made some educated guesses here, but if I worked at Opendoor, these are some of the ‘hard things’ I’d be building:

Unlike Transaction Services, Home Services prolong the relationship with the customer, ensuring Opendoor remains top of mind throughout the entire real estate commerce cycle. Through Home Services, Opendoor will become the de facto operating system of the American home, and these products will make the home feel smarter.

Imagine you just purchased a home with Opendoor. As part of the welcome package, you can log into your Opendoor Home dashboard, which offers detailed financial information such as minute-to-minute home value (backed by an Opendoor offer), mortgage cost (click to refinance), and current equity. But the dashboard will also include things like internet speed, turn lights on and off, garage door up and down, energy efficiency and climate control. Security features will drive engagement, with phone tap to open and lock doors, guest internet access, and alerts for deliveries and doorbells. One-click to ‘Send a Handyman’ when your garbage disposal is acting up.

Want to check on your dog from work? Check the video feed in the Opendoor app — he’s waiting sullenly at the door.

The dashboard will also include a digital twin of your home, where individual rooms can be selected and interacted with. Want to up your design game? Click on your living room and drag and drop 3D furniture integrated from third parties (affiliate marketing) such as Etsy or Pinterest. Unsure what design you’re going for? Click shuffle, and computer vision will outfit the room with the most-liked designs of the season.

Perhaps you want to renovate your master bathroom. Opendoor is already planting seeds here with acquisitions of Skylight and Pro.com. Click “Talk to a Designer Now,” and you’ll be teleported into a virtual meeting to manually redesign your bathroom and discuss ideas in real time.

As an added bonus, the designer can use Opendoor’s automated valuation model (AVM) to predict how the project’s cost will influence the value of the home, marrying creativity with fiscal responsibility.

Each and every customer who purchases an Opendoor home will have access to the Opendoor Home app — which will give them, for the first time, technological control of an intelligent home. A neat bundle for a reasonable subscription fee.

As a brief aside, I have a friend who is a car cognoscenti. He loves classic cars — vintage, low-slung, curvy and chrome. But after driving a Tesla Model S for the first time, he remarked that it made other cars seem “dumb.”

Can you imagine having all the above home functionality at your fingertips and then moving to one without it? As I’ve said before, we never go back. Once a traditional offline process is replaced by a digital experience that is faster, easier, and cheaper, it becomes the new benchmark — the expectation.

Opendoor Home is the chance to convert a one-off and infrequent transaction business into a multi-decade customer relationship, alongside high-margin subscription revenue.

Base Hits vs. Homeruns

Based on Opendoor’s positioning today, the Opendoor Home concept feels neither unachievable nor farfetched. In fact, I would argue this level of 0 to 1 thinking is imperative. Opendoor needs to continue innovating to make these opportunities happen. Opendoor created and dominates an entire category, yes, but must maintain a startup mentality to realize the true potential of the company. Innovation is a road fraught with executional risk, but it is the right one.

“The amount of time a company can count on holding on to market leadership to exploit its earlier innovations is shrinking, and this creates an imperative for even the most entrenched companies to invest in innovation.”

Eric Weiss, The Lean Startup

Over the coming decade, Opendoor must balance two forms of strategic risk. One is mortal risk. These are failures of the core business — overpaying for homes, failing to offer consumer value, or ironclad regulation. Avoiding mortal risk requires conservative paranoia and careful steering. But the other risk is quite the opposite — this is evolutionary risk. If a company fails to harbor an atmosphere of big bets and moonshots, to innovate, it too will be slowly overtaken, and eventually, made extinct.

Properly executed, Opendoor Home is the antidote to any such evolutionary risks.

Taking Off The Rose-Colored Glasses

Risk is an important segue into the headwinds for Opendoor. You’ve heard the headlines — record low home inventory, rising mortgage and interest rates, and a fiery housing bubble that could implode at any time.

I’ve already discussed that interest rates are manageable, and Loup Ventures explained it even more cogently here. Similarly, even with rising mortgage rates, best estimates for 2022 home transactions remain elevated at 6.5 million.

That said, here are three metrics I’m tracking most closely over the coming years and why.

Market Downturn

One of the fairest fears regarding a company holding billions in home inventory on the balance sheet is a market downturn, or a home price depreciation (HPD) environment. But a great deal of thought has been invested into this concern by the Opendoor team. In fact, Rabois previously stated that when backtesting Opendoor’s AVM, even in 2008 the company would not have lost much money.

This makes sense to me — in a down market I believe Opendoor would be able to raise fees and enjoy even higher conversion than it does today. But to confirm, let’s go back to Opendoor’s original investor presentation — the price elasticity of demand curve.

Internalize this graph. It demonstrates that roughly one in four sellers are willing to pay double-digit fees for the immediate liquidity and convenience of an Opendoor offer. Opendoor has continued to lower fees since this investor presentation, and now reports conversion north of 35% with fees of 5%.

But this curve is not fixed.

Price elasticity of demand oscillates based on the market environment. For example, in 2021, the hottest seller’s market of all time, that curve shifted down. This is why conversion was only 35% at even lower fees than you’ll find in the above chart. The liquidity premium is less valuable when it’s easy for a consumer to sell their home.

In a down-market, or a buyer’s market, the opposite phenomenon would be observed. Selling becomes more challenging, and a home depreciates each and every day it sits on the market. Accordingly, a liquidity provider such as Opendoor is much more valuable to the consumer, which means the price elasticity of demand curve would shift up. Opendoor could raise fees and still report higher conversion and marketshare growth than it does today.

People make the mistake of thinking 2021 was a tailwind for Opendoor’s business, that the true test will be a market downturn. This demonstrates a fundamental mischaracterization of the iBuyer model. In reality, 2021 was the headwind, and any future market downturn is Opendoor’s opportunity.

As a final note here, remember that all real estate is local — and markets don’t move in tandem. In 2008, some American markets sank like river stones, others were more gradually affected. Opendoor’s AVM and robust transaction data allow deep insights into short term futures (~45 days). By managing a portfolio of markets, Opendoor will be able to throw leverage into those with the best forward HPA dynamics, and back away from the others — again using scale as a surgical instrument.

Opendoor’s AVM and portfolio diversification, combined with the glacial pace of home price movement, means a down market would not be the thesis killer we automatically assume.

Opendoor’s Holding Times

Rather than HPA, the length of time it takes Opendoor to sell a home after purchase is the metric I most closely monitor. My Q4 2021 checks came back with mean holding times in the 112 – 120 day range. This is higher than I would like to see, likely impacted by overbuying in Q3 (the quarter that broke Zillow), as well as seasonal slowdowns in Q4.

As interest rates inevitably rise, longer holding periods will impact Opendoor’s margins, although this continues to be a very manageable expense. For example, if Opendoor can return to 90 day holding periods, even 3% interest rates would result in only a 0.75% impact on contribution margins after interest (and I don’t think 3% interest rates are remotely likely).

Perhaps most importantly, holding times influence Opendoor’s transaction scale. Opendoor relies on debt and equity to fund home acquisitions — but debt is the oxygen for the bonfire of growth. Holding time dictates how many turns that capital can be reinvested over the course of the year; the shorter the holding time, the further that capital can go.

For example, Opendoor currently has a revolving credit facility of $9 Billion to finance home purchases. If holding times are 120 days, or three transactions in a year, that $9 Billion could be used to generate $27 Billion in revenue (not including HPA or ancillary services). But if Opendoor were able to achieve 60-day turnover times, or six transactions in a year, that $9 Billion could generate $54 Billion in revenue.

Note: Opendoor finances 80-90% of its inventory via debt, and 10-20% via equity capital. As Opendoor has roughly $2 Billion in equity capital, given a range of 120 - 60 day holding times, Opendoor is actually capitalized for a revenue run-rate of $33 - 66 Billion, not including ancillary services.

Holding times massively influence Opendoor’s performance, as well as valuation (EV/GP, for example). Optimization here improves return on invested capital and free cash flow — which is why I track this efficiency metric most closely and with some admitted, occasional, anxiety.

Opendoor’s Brand

I began this article by acknowledging how emotional residential real estate is, as well as its central role in the American Dream. Scott Galloway recently referred to the home as the hippocampus of the brain, where memories reside. Our homes are a refuge for the soul; a nostalgia shop.

Perhaps more than any other business I follow, the brand of the company buying and selling American homes must be preserved and maintained.

I would not invest in Opendoor if I believed they were corporatizing residential real estate at the expense of the American consumer. The last thing we need is another tax on our homes.

But all the evidence — and I’ve looked deeply — all the evidence points to a company empowering the consumer. As a small example, in 2019 Wu said the following to explain his rationale for keeping the Opendoor pricing and cost structure teams separate:

“The structure of the product is that we want to deliver you a valuation that’s objective, that’s based on data, and should inform you on the value that your home is if you sold it today. And we want to charge you a fee for convenience and certainty.

And so decoupling those two teams is actually quite important because there’s an entire team working on reducing the cost structure, and there’s an entire large organization working on pricing. And if you conflate the two, there could be incentives to underpay to achieve P/L goals.”

Opendoor’s offer is Kelley Blue Book. It’s objective, and the valuation is not greased by the opportunistic hands of a Machiavellian corporation. Opendoor will not win the category if it creates the impression of lowballing American consumers for their homes. That Opendoor’s fees are lower than traditional realtors is further evidence of this commitment to the consumer. And as I wrote previously, I expect those fees to continue to fall.

Regardless, Opendoor’s brand is something I will continue to monitor, as the stakes are high and brands are fragile, especially today. There are large networks of individuals who work in offline real estate, who fear their role is being automated away. We saw this with travel agents, taxi drivers, hotel employees, video clerks and brick and mortar retail employees. As the din of offline professionals inevitably condenses into regulatory concerns, Opendoor must be able to point to a pristine track record of consumer value.

It seems like Opendoor is off to a good start.

Closing Thoughts

Opendoor’s first year as a publicly traded company is in the books, but it still feels like early days. Price action will tell you Opendoor is already a failed experiment. Pundits write off its “home flipping” model at first glance. Even Zillow, who was supposed to win the category, shrugged off its iBuying venture like a cheap suit.

Conventional wisdom tells us Opendoor will fail, and conventional wisdom is usually right. But then again, outsized returns often come precisely from betting against conventional wisdom.

“We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that baseball has a truncated outcome distribution.

When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.”

Jeff Bezos, 2015 Amazon Shareholder Letter

Opendoor is empowering the American homebuyer to win what has always been an unfair game. A relentless focus on the customer, a battle-tested culture that can thrive in the harshest of soils, and a product built to be adored, are the deeper features of a generational company discounted.

As we look out to the future, please don’t forget to be bold. I’ve called my shot — and I’ll keep swinging for the fences.

Stay convicted.

Tyler

Enormous thanks to my wife Jennifer for her patience and encouragement to keep writing. Special thanks to my iBuying Twitter research team, who I believe are thinking harder about this company than anyone else, building the most accurate home transaction data tools in the space. And to you, noble reader, a mountain of my gratitude if you click any of the below buttons.

As always, feel free to find me on Twitter to let me know what you liked and what you didn’t about this post.

Below you will find additional content I used for inspiration for this post, as well as my recent interviews regarding Opendoor:

1.) Moneyball: The Art of Winning an Unfair Game.

2.) PropTech Insights from Opendoor CEO Eric Wu 2019, YouTube interview.

3.) Scaling for Growth - Eric Wu + Elad Gil, YouTube interview

4.) Keith Rabois' home-buying disruptor Opendoor, politics, innovation, YouTube interview.

5.) Jeff Bezos 2015 Shareholder Letter (and attached 1997 Shareholder Letter).

6.) My discussion with Emmanuel Finance on Opendoor and investing, January 2022.

7.) My discussion with Alpha Bets on Opendoor, Part 1 and Part 2, January 2022.

8.) My podcast discussion with Beating the Market on Opendoor, February 2022.

9.) Opendoor: The Mythology of Disruption, September 2021.

10.) Link to the original title art for the Moneyball movie.

11.) Tyler Okland, MD

Literally printed this out to read. Really appreciated your writing and well thought out thesis on this company. Keep it up!! Hoping we OPEN Investors are on to something huge!

Your thoroughness and generosity for sharing hours of research are greatly appreciated, and continually renew my conviction in this investment. Please continue the excellent work.