Crypto Dividends

Could This Be The Best Of Both Worlds?

Welcome to the 308 new and curious minds who have joined The Operator since October 19! If you are reading this but have not subscribed, join 850 affable and punctual others by subscribing here:

Hey team 👋

Life moves pretty fast.

I’m not sure if you’ve been on Twitter lately, but it seems like every day I wake up to a new science fiction headline about the metaverse, self-driving cars, AI, deep-learning, NFT’s or crypto.

For many, the peregrine velocity of innovation leaves a bitter taste, the fear of the unknown — a sense that these complex developments are inaccessible.

It’s easy to say we’re too busy, too disinterested, to learn about the rapid changes shaping our digital tomorrow. But I fear the accelerating pace of innovation risks the incurious student being left behind, a stranded, low-tech pariah.

These two fears, of the unknown and FOMO, make bedlam in the background as we contemplate the headlines of today. But there’s a sweet victory in learning to separate noise from signal. I want us to feel like we’re part of this digital revolution, rather than apart from.

So today, I aim to introduce a new financial concept — one that marries the comforts of traditional investing with the opportunity of generational wealth. This article is for all comers — your dad with cash in the mattress as much as your sister with thousands of Dogecoin sitting in Robinhood.

I humbly present to you the best of both worlds: crypto dividends.

The Investment Opportunity

What if I told you we could invest in an asset averaging triple digit annual returns for over a decade, and that this asset also pays a dividend of 8.0%. Would that be something you might be interested in?

I’m talking, of course, about crypto interest accounts.

The idea here is similar to depositing money in a savings account, but instead of depositing and earning dollars, it’s crypto. By holding crypto in these applications you earn interest, dividends, or yield. Sounds easy enough, right?

But like Clark Kent behind a pair of unfashionably square spectacles, superpowers lurk within. Crypto superpowers.

Let’s back up. The APY (annual percentage yield) for my Wells Fargo savings account today is 0.01%. In my opinion, while slightly better than a mattress full of cash, holding money in a savings account today with 5+% inflation is simply fiscally irresponsible.

Rather than a savings account, just burn that money to keep warm this winter.

Source: U.S. Bureau of Labor Statistics

Alternatively, you could hold your hard-earned money in crypto interest accounts. On the applications we will discuss today, the APY ranges from 5.0 - 9.0%. This percentage is paid in the crypto you denominate, monthly, weekly, or even hourly. That sure beats quarterly dividends, doesn’t it?

But the superpowers don’t stop there. Because these dividends are paid in crypto, rather than a specific dollar amount, there is opportunity for those outsized yield figures to expand further.

Let me give you an example. On September 28, I logged into my FTX application and purchased 60 Solana at a price of $134/coin, for a total of $8,040. At 8% APY, I expected to earn 4.8 Solana coins over the course of the year, for a total of $643 in crypto dividends. Score.

Fast forward four weeks later and Solana is valued at $206/coin. Now don’t get me wrong, a 54% return in three weeks is tremendous. But what I’m most excited about is that the yield on my original investment has also risen by 54%. I continue to earn 4.8 Solana as dividends, but the value of those coins is now $989, which is 12.3% yield on my original investment. This is markedly different from investing in a dividend stock, for example, where the dividend is static regardless of stock price movement.

You’re perhaps wondering — what’s the catch? How do these applications make money if they’re handing out 8% dividends? You’re absolutely right to be skeptical — there’s no such thing as a foolproof investment. You’re not Nancy Pelosi.

But How Do Crypto Interest Accounts Work?

There are two reasons these applications can offer such high interest rates: contango, and capital scarcity for large crypto trades. This is the only technical segment of the article, so stay with me.

Like any commodity, bitcoin has a ‘spot’ price and a ‘future’ price. Spot is the price of right now; the price you see listed on Robinhood, SoFi, Coinbase; any exchange. Bitcoin’s futures price is what people expect bitcoin to be in, well, the future. This price can be found on derivatives exchanges like the CME, Binance, FTX or OKEx. When the future price of a commodity is higher than its spot price, it’s called contango. This generally occurs when investors believe the price of an asset will be worth more in the future than it is today. Bitcoin spends a lot of time in contango.

Importantly, contango creates an arbitrage opportunity. Hedge funds can simultaneously purchase spot bitcoin in one market and sell bitcoin futures in another market, collecting the difference. This is what’s known as a basis trade, and in this circumstance, it’s nearly riskless.

If oil prices were in contango, for example, hedge funds would borrow billions of dollars from banks to lever up and profit from these basis trades. But banks are wary of lending capital for crypto trades, which means loan supply is scarce.

Enter FTX and BlockFi.

Alongside a host of newfangled cryptobanks, FTX and BlockFi loan stablecoin deposits to hedge funds seeking arbitrage trades. FTX and BlockFi can offer 8 - 9% APY because they charge hedge funds > 9% APY for loans, and hedge funds can pay that amount because the basis trade is even more profitable.

That’s it. The long and the short of it.

While it’s important to understand how these products work, even more critical is internalizing the risks of a given investment.

FTX and BlockFi are not FDIC insured. In a black swan event, if these businesses went bankrupt, your account could go to zero. That said, FTX and BlockFi have taken significant steps to bolster risk management. I think this risk is exceedingly low, and I’ve put my money where my mouth is. Today, a not insignificant amount of my net worth is spread between FTX and BlockFi. The true material risk to using an interest-bearing crypto account is that crypto can go down. Crypto isn’t immune to gravity, and has historically fallen hard in downturns. Do your own due diligence.

But what this really boils down to is whether or not you believe crypto will carve out a permanent place in our digital future. I write a lot of words every month and read perhaps 10X that figure, but I write the following with as much conviction as I can muster:

Crypto is here to stay.

Frankly, I feel silly even having to say this, but then again, even well-respected bankers like JP Morgan CEO Jamie Dimon continue to express skepticism with the asset class. Meanwhile, the total crypto market cap approaches $2.5 Trillion, and we’ve explored the crypto universe to roughly the same extent we’ve explored our own.

While this article is in no way a deep dive on the merits of crypto, allow me to inject three talking points for bitcoin, crypto-figurehead and perhaps the most palatable entry for the uninitiated. Note, I am long bitcoin, Ethereum and Solana (not in that order), and I intend to write many more words on these three over the coming months.

1.) Bitcoin is deflationary: Bitcoin is software. It’s elegant code that observes pre-programmed rules. Chiefly amongst those rules is that there will only ever be 21 million bitcoin issued. Today, there are 18.85 million bitcoin in circulation, roughly 90% of that total figure. By 2024 the annual rate of supply increase will drop below 1% (which is well below gold, by the way). The last bitcoin will not be mined for over a century.

In an era of aggressive monetary supply policy with CPI values shattering glass ceilings, deflationary hedging is not just recommended, it is necessary. The finite and decentralized nature of bitcoin means demand will never be met by supply. At the bare minimum, this makes bitcoin better than cash as a hedge on inflation.

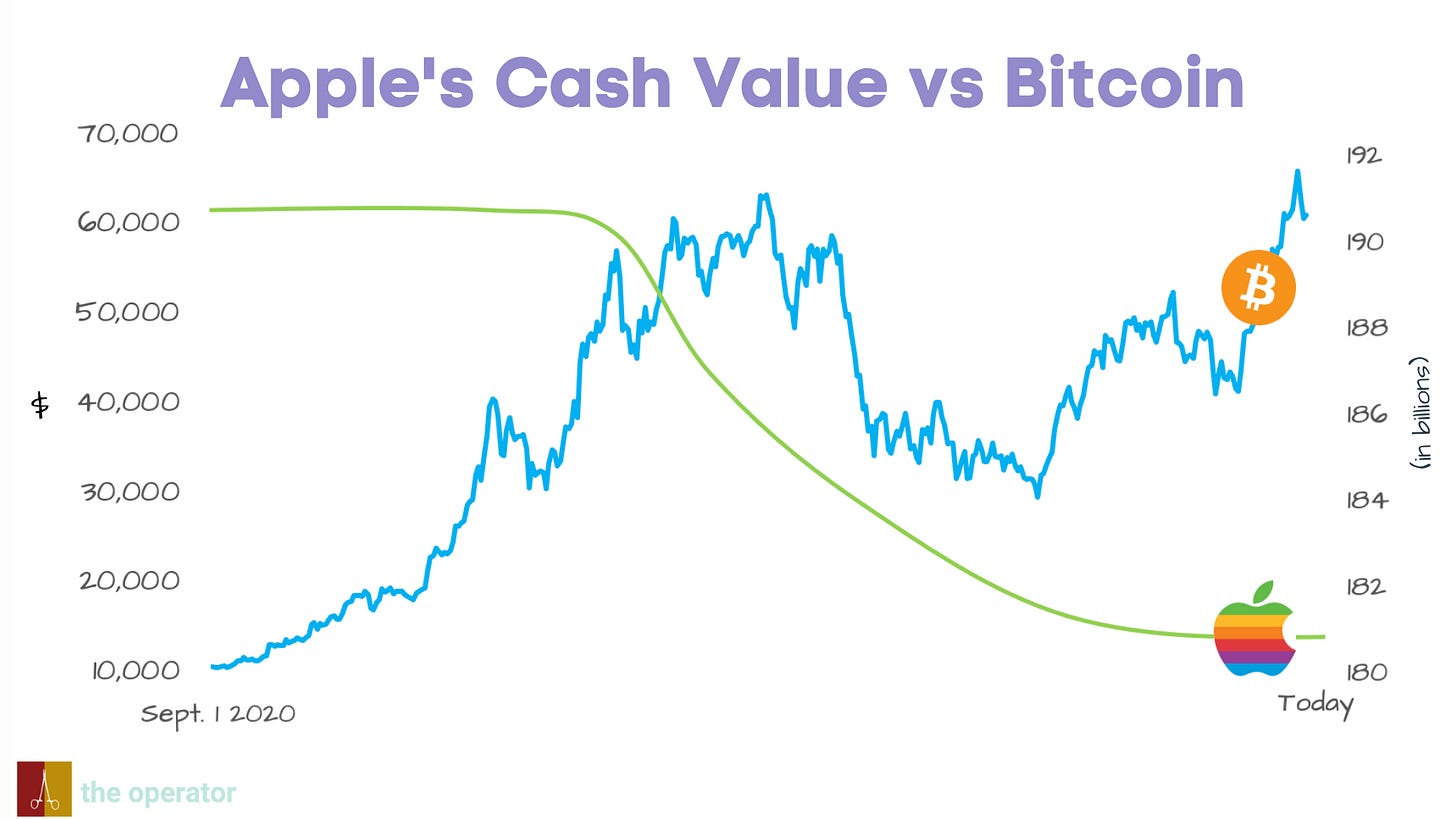

Elon Musk and Jack Dorsey have used this crypto treasury approach to the benefit of Tesla and Square shareholders, respectively. While this has not exactly caught on amongst Fortune 500 companies, it should. Back of the napkin math tells me Apple has lost over $10 Billion dollars on inflation alone since Sept. 2020 by sitting on nearly $200 Billion in cash.

Coincidentally, Bitcoin is up 460% since then.

At some point, shareholders need to challenge the Apple’s of the world to stop playing a defense that’s doomed to fail, to start playing some offense. Sitting on a pile of cash today is not defensive, it’s destroying shareholder value.

This is no less true for individual investors — exposure to deflationary assets is a must in our post-stimulus world.

2. Bitcoin eliminates value-destroying middlemen: In my most recent article, Unity: The World Engine, we talked about how owning the middle results in powerful, resilient businesses. Similarly, much of the philosophical ethos of cryptocurrency involves displacing the banking and credit card cartels who stand in the middle and silently harvest portions of, our financial transactions.

Let me unpack that statement. In a typical credit card transaction there are a multitude of middlemen — the payment processor, the credit card network, the acquiring bank, and the issuing bank — each of whom find a way to profit from you purchasing a Squid Game tracksuit for Halloween. Credit card processing fees range from 1.5 - 3.5% per transaction, not including the payment processor’s cut.

Said another way, as consumers, we are paying several percentage points of tax on each and every credit card transaction. Merchants are forced to raise prices to neutralize these fees, and small business owners and entrepreneurs are disproportionately affected.

But with crypto, none of the above is necessary. Transactions are limited to customer and merchant, no middlemen, no hidden taxes.

Or at least, this is the goal. The infrastructure is in the wings.

Scalability of bitcoin and Ethereum has so far failed to match demand. Bitcoin can only handle 7 transactions per second (TPS), compared to 30 for Ethereum and 24,000 for Visa (meanwhile Solana managed to hit 400,000 TPS before breaking down 👀). This has resulted in high-fees, congested networks, and poor UX for those transacting in crypto.

But devs are hard at work to solve these problems.

The Lightning Network, which is a payment layer built on top of the bitcoin blockchain, is one such solution. A single channel in the Lightning Network can process over 250 TPS, and there’s no limit to how many channels may join the network. This is just beginning to scale, but early results are promising.

The Ethereum team is meanwhile constructing the Ethereum 2.0 upgrade, aimed at increasing transaction capacity, reducing fees and making the network more sustainable. While the upgrade won’t be live until early 2022, it has the potential to (one day) increase Ethereum’s TPS to 100k or more.

That brings us to talking point #3.

3. Bitcoin is just getting started: I hear so many people question whether or not it makes sense to invest in crypto today, given proximity to all time highs. But in my opinion, the entire crypto space has many, many multiples of appreciation ahead. In fact, I think we are just getting started.

Worldwide, there are perhaps 300 million people using crypto today, on a planet with a population of 7.9 billion. That’s a penetration of roughly 3.8%.

It will never be harder to use crypto in a financial transaction than right now. Interacting with crypto today is frustrating and slow, with underdeveloped user interfaces. But despite those headwinds, crypto has reached critical mass — an inflection point.

We are just beginning to experiment in the space — crypto interest accounts, play to earn games, tipping creators on Twitter, staking in DeFi, legal tender for countries and as a treasury asset for mega-cap tech companies. These use cases are not just expanding, they are exploding. As more and more brilliant devs lever their attention towards optimizing bitcoin — UX, infrastructure, and utility will follow.

Crypto Interest Accounts

Okay, now that you can describe contango, deflationary hedging and how crypto interest accounts work at a party, let’s take a look at my two favorite applications for crypto interest accounts — BlockFi and FTX.

Founded in 2017, BlockFi is a crypto-native financial institution that offers four primary products — interest accounts, trading accounts, crypto-backed loans and a credit card. Following a $350 Series D in March, 2021, BlockFi’s private valuation crested $3 Billion, and touts a who’s who of investors including Bain Capital, Valar Ventures (Peter Thiel LoTR reference, anyone?), Tiger Global, SoFi, Coinbase Ventures, Pomp Investments and DST Global.

On BlockFi’s interest account, users can purchase up to eight distinct crypto assets in addition to two stablecoin offerings (USDC and GUSD). Interest rates vary for each asset and by month, although the full breakdown can be found here.

Note: As of Nov 1, 2021, the USDC and GUSD APY is 9% for 0 - 40k and 8% for > 40k.

BlockFi has two evident advantages over FTX as a crypto interest account:

1.) BlockFi offers higher stablecoin APY, with 9% up to $40k, and 8% on anything higher than that. Compare this to FTX, which offers 8% on everything (stablecoins included) up to $10k, and 5% on balances > $10k. BlockFi interest is paid out at the end of each month.

For example, if you deposited $100k in cash onto BlockFi, it would be immediately converted into stablecoin (GUSD), and you would annually earn 0.09 * 40,000 + 0.08 * 60,000, for a total of $8,400. With FTX, that total would be $5,300. That’s a savings account with crypto superpowers.

2.) With Flex, users can choose which currency to be paid in. For instance, a user can hold bitcoin on the app and earn interest paid in Eth or dollars. Similarly, you could hold cash and earn 9.0% interest paid in bitcoin. On FTX, interest is earned only in the asset being held.

Overall I enjoy the BlockFi application, and think it is a particularly strong alternative to a traditional savings account. If you are interested in exploring the BlockFi app, here is a link. Note — this is not my referral link, I get no rewards for you clicking, and I am not being paid by BlockFi, nor am I invested in the company.

That brings us to application #2 — FTX.

FTX was founded in 2017 by one of the most widely respected names in crypto, Sam Bankman-Fried — and he’s building a monster. Just last month FTX raised a $420 million Series B at a valuation of $25 Billion.

If you haven’t read about FTX yet, perhaps you’ve seen the commercials with Tom Brady, the ads on Barstool Sports, the logos on the uniforms of MLB umpires, or maybe attended a game at ‘FTX Arena’, home of the Miami Heat.

Not bad for a company going on 4 years old. Again, life moves pretty fast.

FTX is a cryptocurrency-exchange platform with advanced features such as options, derivatives, prediction markets, leveraged tokens and NFT’s. Currently, FTX offers 8.0% APY on 24 distinct assets, including cash, bitcoin, Ethereum, and Solana. This 8.0% is extended to deposits up to $10k, and any balance higher earns an APY of 5.0%.

Below are sample screenshots I took from my mobile FTX dashboard.

The addition of dividend coins to the account in real time is perhaps the most compelling aspect of this product. For example, if you check your ‘total earned’ coin balance at 1 pm, it will be higher than it was at noon, and whatever you earned is yours immediately. Since September 28th, I have earned nearly half a Solana coin, and 0.05 Eth. Not exactly life-changing, but as a passive income junkie I love this.

At the end of October I ended up moving most of my BlockFi crypto balance over to FTX for the following three reasons:

1.) You can buy Solana on FTX, which I am increasingly bullish on. Solana is not available on BlockFi (yet).

2.) FTX offers 8% on all deposits up to $10k (BlockFi offers 9.0% APY on stablecoin deposits up to $40k USD, but lower for crypto — 4.5% for BTC and 5.0% for Eth).

3.) FTX pays yield in real time, as opposed to at the end of the month. While this offers slightly better compounding opportunity, I really just like seeing my coins add up in real time. It’s a remarkably satisfying UX.

If you are interested in exploring the FTX app, here is the link (Again, I get no rewards for you clicking, and I am not being paid by FTX, nor am I invested in the company).

While a $10k Bitcoin investment in FTX or BlockFi might not make you a millionaire, you never know. When it comes to crypto, even a small amount of capital invested patiently has a nonzero chance of building generational wealth. But when you combine crypto superpowers with the magic of compounding, that chance ticks even higher.

These are the types of asymmetric bets I’m aiming for.

I could, and perhaps one day will, write entire deep dives on BlockFi and FTX — the different offerings, founding mythology, and investment opportunity. I would probably invest in both if I could, and will be watching for IPO news from the sidelines.

Closing Thoughts

The internet is the wild west right now — Facebook is rebranding itself after the metaverse, JPEG’s are being purchased for half a billion dollars, OpenAI is building artificial intelligence that can score a perfect SAT…

And then there’s crypto — the wildest of them all.

With this article I endeavored to present a financial concept that marries responsible investing with the crypto opportunity — crypto dividends. This is just another step along the wandering path that (I believe) inevitably leads to mass crypto adoption, and it’s my hope we all end up there together.

An allocation to crypto belongs in any diversified portfolio today. If you were on the fence, perhaps the concept of crypto dividends was all you needed to dip your toes in the warm, digital water. I sleep easier at night knowing my capital, imbued with crypto superpowers, is working for me.

Stay convicted.

Thanks to Jennifer for feedback on graphics and for trialing both the BlockFi and FTX apps. Thanks to Steven Fiorillo for expert assistance on compound interest modeling, and for agreeing it was harder than it initially seemed.

Biggest thanks to you all for reading, sharing and subscribing. The feedback has been tremendous, and is what motivates me to set my alarm a few hours earlier to write these articles 🤓

As always, feel free to find me on Twitter to let me know what you liked and what you didn’t about this post.

Thanks for the superb article! So well documented and structured. I have a question: do you know of any BlockFi or FTX equivalent that would be accessible in Canada?

Superb article as always. I feel like a fanboy having to comment on every article but, as I’ve said before, they are so well written they make complicated topics easily digestible and accessible for people who may not be as well versed in the area. Am also long BTC, Eth and Sol. Unfortunately, I bought sol on Revolut which, for now, does not support staking and does not allow you transfer your coins. I know. Have you looked into Ohm and the Olympus DAO? My first foray into staking. Again, you can see your interest or earned coins accumulate in real time which, as you said, is very satisfying!